Shell Oil Company is now producing oil from the world’s deepest subsea

well at its Perdido Development, utilizing advanced technology to lead

the way in increasing the company’s ability to produce more domestic oil

and gas resources.

The well, at 9,627 feet below the water’s surface, is located in the

Tobago Field 200 miles southwest of Houston in the ultra-deep water of

the Gulf of Mexico.

Tobago is jointly owned by Shell (32.5%, as operator), Chevron (57.5%),

and Nexen (10.0%) and is one of three fields producing through the

Perdido drilling and production platform.

Tobago breaks the world water depth record for subsea production, previously held by another field in the Perdido Development, the Silvertip field at 9,356 feet of water.

“Energy is fundamental to global economic growth. Providing this energy

must be met practically, safely and in an environmentally responsible

manner,” said Marvin Odum, Upstream Americas Director. “Through our

highly skilled workforce and cadre of global geoscientists, Shell has

applied its advanced seismic and drilling technologies at Perdido to produce additional sources of oil and gas.”

Moored in about 8,000 feet of water, the Perdido platform is jointly

owned by Shell (33.34%), BP (33.33%) and Chevron (33.33%) and is the

deepest drilling and production facility in the world with a capacity to

handle 100,000 barrels of oil per day and 200 million standard cubic

feet of gas per day. From Perdido, Shell accesses the Great White,

Tobago, and Silvertip oil and gas fields through subsea

wells directly below the facility and from wells up to seven miles

away. At its peak, Perdido can produce enough energy to meet the needs

of more than two million US households. Shell operates Perdido and its

satellite fields on behalf of partners Chevron, Nexen, and BP.

This world-class project began with the 1996 lease sale when the

technology to develop hydrocarbons at Perdido’s water depth did not yet

exist. By the time the final investment decision for commercial

development was made in October 2006, Shell had pioneered several

technological firsts which allowed the company to proceed with ultra deepwater

oil and gas production. Development drilling began in July 2007, five

years after the discovery of hydrocarbons. Perdido produced its first

oil and gas on March 31, 2010.

miercuri, 23 noiembrie 2011

marți, 22 noiembrie 2011

Cairn India unit makes second gas discovery in Sri Lanka

MUMBAI -- Cairn India Ltd. said unit Cairn Lanka Pvt. Ltd. has made a second gas discovery in the Mannar Basin of Sri Lanka.

Cairn Lanka made the discovery at the CLPL-Barracuda-1G/1 well in the SL 2007-01-001 exploration block, and the Sri Lankan government has been informed about the discovery, Cairn India said in a statement.

The discovery is located about 68 kilometers from the Sri Lanka coastline, and Cairn Lanka is the sole operator of the block with 100% working interest.

"The reservoirs are predominantly gas bearing with some additional liquid hydrocarbon potential," Cairn said, adding that it will "evaluate the well results and work with appropriate authorities to determine the commercial potential of this discovery."

The company said that the exploration program includes three wells and that it expects to complete the program by early next year, after which it will provide an update on the drilling results.

In October, Cairn Lanka said it made its first gas discovery in Sri Lanka in the Mannar Basin. It was the first hydrocarbon discovery in Sri Lanka and the first well to be drilled there in 30 years.

Cairn Lanka made the discovery at the CLPL-Barracuda-1G/1 well in the SL 2007-01-001 exploration block, and the Sri Lankan government has been informed about the discovery, Cairn India said in a statement.

The discovery is located about 68 kilometers from the Sri Lanka coastline, and Cairn Lanka is the sole operator of the block with 100% working interest.

"The reservoirs are predominantly gas bearing with some additional liquid hydrocarbon potential," Cairn said, adding that it will "evaluate the well results and work with appropriate authorities to determine the commercial potential of this discovery."

The company said that the exploration program includes three wells and that it expects to complete the program by early next year, after which it will provide an update on the drilling results.

In October, Cairn Lanka said it made its first gas discovery in Sri Lanka in the Mannar Basin. It was the first hydrocarbon discovery in Sri Lanka and the first well to be drilled there in 30 years.

luni, 21 noiembrie 2011

ExxonMobil to explore for oil in Iraqi Kurdistan

LONDON -- ExxonMobil Corp. has signed agreements to

explore for oil and gas in six blocks in the Kurdish region of Iraq,

Michael Howard, communications adviser to the Resources Minister of the

Kurdistan Regional Government, told Dow Jones Newswires Friday.

He declined to give further details.

ExxonMobil is the first of the major international oil companies to reach such an agreement with the KRG, which has long been in dispute with Iraq's central government over its right to issue oil exploration licenses.

ExxonMobil declined to comment on the agreement.

ExxonMobil is already operating in Iraq, producing around 370,000 barrels a day of oil from the West Qurna field, under a service contract with the Baghdad government. The Baghdad government has previously excluded companies operating in the Kurdish region from oil contracts in the rest of the country.

He declined to give further details.

ExxonMobil is the first of the major international oil companies to reach such an agreement with the KRG, which has long been in dispute with Iraq's central government over its right to issue oil exploration licenses.

ExxonMobil declined to comment on the agreement.

ExxonMobil is already operating in Iraq, producing around 370,000 barrels a day of oil from the West Qurna field, under a service contract with the Baghdad government. The Baghdad government has previously excluded companies operating in the Kurdish region from oil contracts in the rest of the country.

vineri, 18 noiembrie 2011

Uganda: Oil exploration investment hits $1.5 billion

KAMPALA Uganda -- Oil companies operating in

Uganda's Lake Albertine Rift basin have invested at least $1.5 billion

in oil and gas exploration since 2006, and investments are expected to

keep increasing as the country moves from exploration to the development

phase, Uganda's energy and minerals ministry said Thursday.

In a report, the ministry said the investments have led to the drilling of at least 55 oil wells with 51 of these yielding oil discoveries in three oil blocks on the Ugandan side of the Lake Albertine rift basin.

"This (exploration) represents a success rate of over 92%," the ministry said." Government will continue to pursue investment promotion in the sector with the aim of undertaking further exploration in order to increase the amount of exploitable oil and gas."

The country is expected to call for bids for at least five unlicensed oil blocks early next year, as well as at least 10,000 square kilometers of acreage, relinquished by the current players when the necessary oil legislation have been formulated, the ministry said.

U.K.-based Tullow Oil PLC, which operates the three blocks, is currently in advanced stages of selling two thirds of its stakes in the blocks for $2.9 billion to France's Total SA and China's CNOOC Ltd.\).

In a report, the ministry said the investments have led to the drilling of at least 55 oil wells with 51 of these yielding oil discoveries in three oil blocks on the Ugandan side of the Lake Albertine rift basin.

"This (exploration) represents a success rate of over 92%," the ministry said." Government will continue to pursue investment promotion in the sector with the aim of undertaking further exploration in order to increase the amount of exploitable oil and gas."

The country is expected to call for bids for at least five unlicensed oil blocks early next year, as well as at least 10,000 square kilometers of acreage, relinquished by the current players when the necessary oil legislation have been formulated, the ministry said.

U.K.-based Tullow Oil PLC, which operates the three blocks, is currently in advanced stages of selling two thirds of its stakes in the blocks for $2.9 billion to France's Total SA and China's CNOOC Ltd.\).

joi, 17 noiembrie 2011

Eni's giant Libyan oil field Elephant restarts production

LONDON -- A giant Libyan oil field partly owned by

Eni SpA restarted production Thursday, a top official at the Libyan

company overseeing the operation said Thursday, well-ahead of

expectations as the country's post-war oil resumption gains momentum.

In an interview, Mohamed Jamaleddin, a member of the management committee of Mellitah Oil and Gas BV, said "we started the [first] well gradually" at the Elephant field in the Southern desert.

Reports had previously suggested it could take many months to restart the facility after it was damaged and shutdown during the civil war.

Eni couldn't immediately comment Thursday.

The resumption of Eni's largest Libyan field comes after the recent restart of Repsol YPF SA's giant Sharara field.

Libya now expects production to reach up to 800,000 barrels a day by year end--about half of its pre-war production--, Nuri Berruien, chairman of Libya's National Oil Co., said earlier Thursday.

Mellitah's Jamaleddin also said the "pipeline operation already started" from Elephant at a flow of 40,000 barrels a day, though it is currently transporting oil stored at the field.

Elephant's output normally accounts for about 25% of Eni's Libyan production and, according to Jamaleddin, averaged 130,000 barrels a day before the war.

"Return to full production will take a bit more time," he said. It is currently restricted by limited availability at the local export terminal and will depend on the condition of the wells that are still closed, the official said.

But another Libyan oil official said it could take as little as a week to return to normal.

In another piece of positive news for Eni's Libyan operations, NOC's Berruien said production at the 40,000 barrels-a-day offshore Bouri field could restart "anytime, very soon" but within a week.

In an interview, Mohamed Jamaleddin, a member of the management committee of Mellitah Oil and Gas BV, said "we started the [first] well gradually" at the Elephant field in the Southern desert.

Reports had previously suggested it could take many months to restart the facility after it was damaged and shutdown during the civil war.

Eni couldn't immediately comment Thursday.

The resumption of Eni's largest Libyan field comes after the recent restart of Repsol YPF SA's giant Sharara field.

Libya now expects production to reach up to 800,000 barrels a day by year end--about half of its pre-war production--, Nuri Berruien, chairman of Libya's National Oil Co., said earlier Thursday.

Mellitah's Jamaleddin also said the "pipeline operation already started" from Elephant at a flow of 40,000 barrels a day, though it is currently transporting oil stored at the field.

Elephant's output normally accounts for about 25% of Eni's Libyan production and, according to Jamaleddin, averaged 130,000 barrels a day before the war.

"Return to full production will take a bit more time," he said. It is currently restricted by limited availability at the local export terminal and will depend on the condition of the wells that are still closed, the official said.

But another Libyan oil official said it could take as little as a week to return to normal.

In another piece of positive news for Eni's Libyan operations, NOC's Berruien said production at the 40,000 barrels-a-day offshore Bouri field could restart "anytime, very soon" but within a week.

miercuri, 16 noiembrie 2011

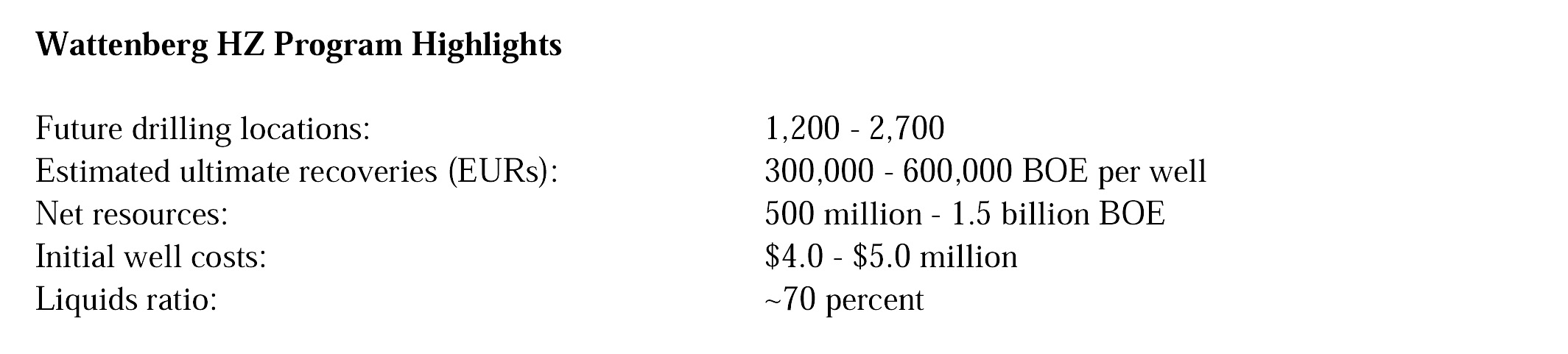

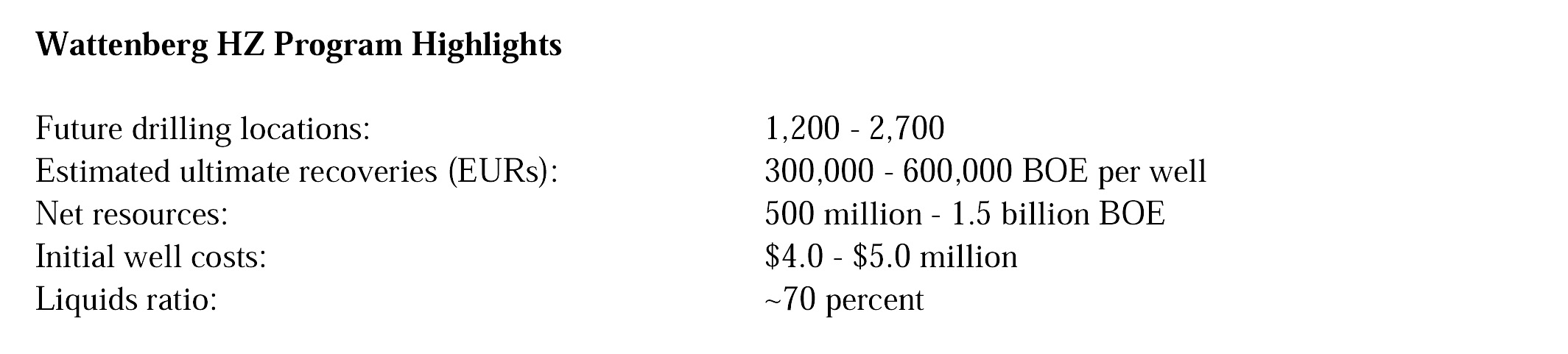

Anadarko reports 1.5 billion bbl find at Niobrara prospect

HOUSTON, TX -- Anadarko Petroleum Corporation

provided an update on its Horizontal Niobrara and Codell drilling

program in the Wattenberg field (Wattenberg HZ) of northeastern

Colorado. To date, the company is producing from 11 horizontal wells

within the Wattenberg field boundaries, with each well achieving strong

initial rates and high liquids yields.

"Based upon the early results of Anadarko's program in the Wattenberg field, we are confident the liquids-rich Horizontal Niobrara and Codell opportunity provides a net resource potential of 500 million to 1.5 billion BOE (barrels of oil equivalent); and it's located right in the heart of one of our existing core areas," said Anadarko Sr. Vice President, Worldwide Operations, Chuck Meloy. "Our activity, which has primarily targeted the Niobrara formation within the Wattenberg field boundaries, has achieved high liquids yields and excellent well performance with average initial production rates of about 800 BOE per day. The value of this resource is further enhanced by our extensive mineral ownership throughout the Land Grant that provides royalty revenue on both operated and non-operated activity. Our strategic acquisitions of and access to midstream assets in the region that include operated infrastructure, takeaway capacity, NGL (natural gas liquids) processing, and the White Cliffs Oil Pipeline provide us with an additional economic advantage. We expect the alignment of our assets, coupled with future investments in expansion opportunities, will continue to enhance field recoveries, access to premium markets and robust margins."

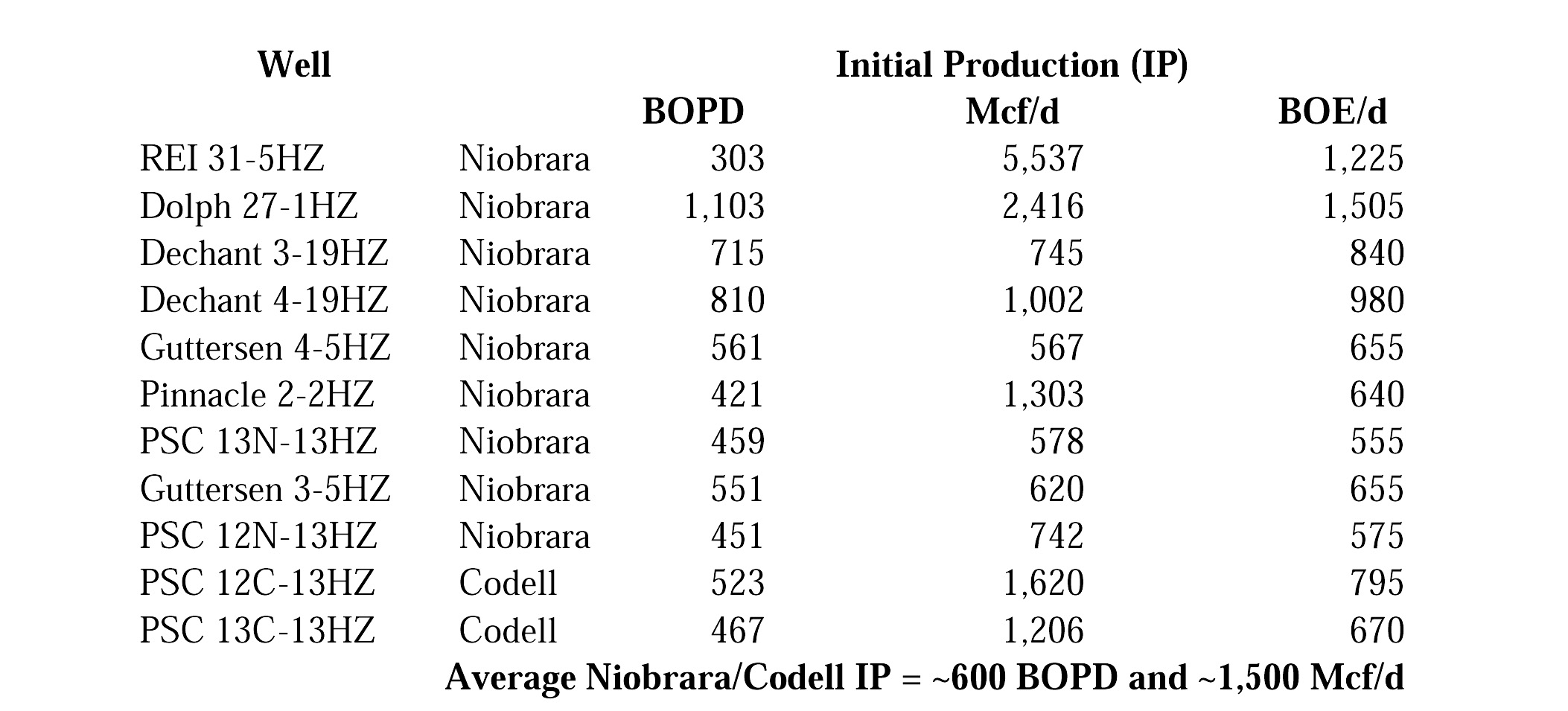

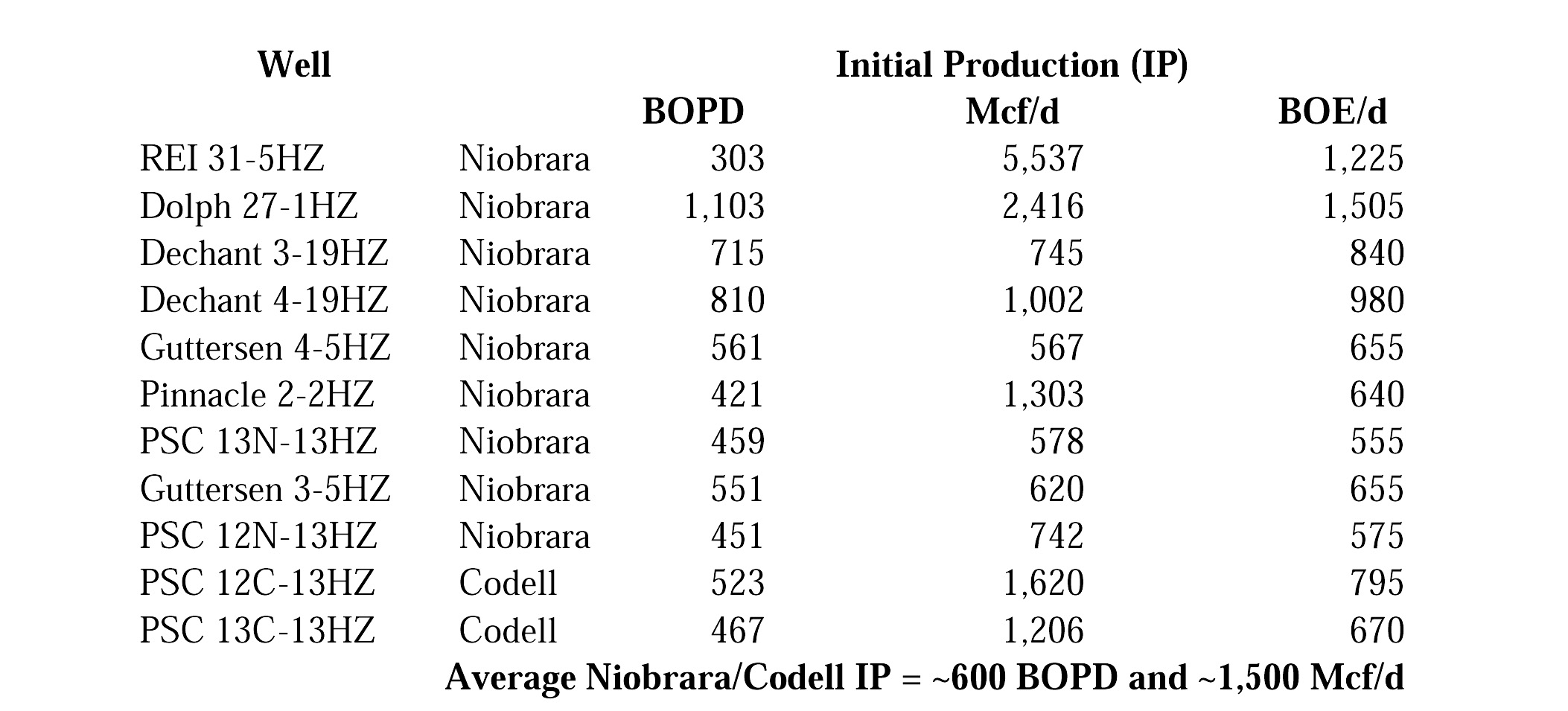

Anadarko's best horizontal well to date, the Dolph 27-1HZ, demonstrated an initial production (IP) rate of more than 1,100 barrels of oil per day (BOPD) with more than 2.4 million cubic feet of natural gas per day (MMcf/d), resulting in an estimated EUR of better than 600,000 BOE. The Dolph well also paid out in less than four months. Results of the company's first 11 operated Horizontal Niobrara and Codell wells are as follows:

Anadarko is the largest net producer in the liquids-rich Denver-Julesburg (DJ) Basin at greater than 70,000 BOE per day. The company holds interests in more than 350,000 net acres in the Wattenberg field, and operates more than 5,200 existing wells with an average working interest of approximately 96 percent, and an average net revenue interest of approximately 88 percent.

As part of its ongoing program, Anadarko will be conducting extensive tests to define the optimum spacing and lateral lengths for the Niobrara and Codell formations. The company also plans to increase the Wattenberg HZ drilling program to seven rigs by the end of 2012, while increasing the number of horizontal wells drilled during the year to approximately 160 from about 40 in 2011.

"The results to date demonstrate the Wattenberg HZ program is among the most cost-efficient development projects in our U.S. onshore portfolio, and with initial wells averaging payouts of 10 months, we expect it to quickly become a self-funding, significant cash-flow generator," said Meloy. "With our extensive land position and the drilling results to date, we envision drilling another 1,200 to 2,700 horizontal wells in the core Wattenberg field acreage. Another value addition for our shareholders is our team's demonstrated ability to apply lessons learned in our other resource plays to optimize the learning curve, and we expect to achieve improvements in drilling, completion and reservoir performance as we've successfully done in the Eagleford and Marcellus shales.

"Outside the Wattenberg field, we're also exploring additional liquids-rich horizontal opportunities where we hold another 550,000 net acres in the greater DJ Basin and 360,000 net acres in the Powder River Basin. Each area is prospective for the Horizontal Niobrara, as well as other horizons that we will evaluate over time."

"Based upon the early results of Anadarko's program in the Wattenberg field, we are confident the liquids-rich Horizontal Niobrara and Codell opportunity provides a net resource potential of 500 million to 1.5 billion BOE (barrels of oil equivalent); and it's located right in the heart of one of our existing core areas," said Anadarko Sr. Vice President, Worldwide Operations, Chuck Meloy. "Our activity, which has primarily targeted the Niobrara formation within the Wattenberg field boundaries, has achieved high liquids yields and excellent well performance with average initial production rates of about 800 BOE per day. The value of this resource is further enhanced by our extensive mineral ownership throughout the Land Grant that provides royalty revenue on both operated and non-operated activity. Our strategic acquisitions of and access to midstream assets in the region that include operated infrastructure, takeaway capacity, NGL (natural gas liquids) processing, and the White Cliffs Oil Pipeline provide us with an additional economic advantage. We expect the alignment of our assets, coupled with future investments in expansion opportunities, will continue to enhance field recoveries, access to premium markets and robust margins."

Anadarko's best horizontal well to date, the Dolph 27-1HZ, demonstrated an initial production (IP) rate of more than 1,100 barrels of oil per day (BOPD) with more than 2.4 million cubic feet of natural gas per day (MMcf/d), resulting in an estimated EUR of better than 600,000 BOE. The Dolph well also paid out in less than four months. Results of the company's first 11 operated Horizontal Niobrara and Codell wells are as follows:

Anadarko is the largest net producer in the liquids-rich Denver-Julesburg (DJ) Basin at greater than 70,000 BOE per day. The company holds interests in more than 350,000 net acres in the Wattenberg field, and operates more than 5,200 existing wells with an average working interest of approximately 96 percent, and an average net revenue interest of approximately 88 percent.

As part of its ongoing program, Anadarko will be conducting extensive tests to define the optimum spacing and lateral lengths for the Niobrara and Codell formations. The company also plans to increase the Wattenberg HZ drilling program to seven rigs by the end of 2012, while increasing the number of horizontal wells drilled during the year to approximately 160 from about 40 in 2011.

"The results to date demonstrate the Wattenberg HZ program is among the most cost-efficient development projects in our U.S. onshore portfolio, and with initial wells averaging payouts of 10 months, we expect it to quickly become a self-funding, significant cash-flow generator," said Meloy. "With our extensive land position and the drilling results to date, we envision drilling another 1,200 to 2,700 horizontal wells in the core Wattenberg field acreage. Another value addition for our shareholders is our team's demonstrated ability to apply lessons learned in our other resource plays to optimize the learning curve, and we expect to achieve improvements in drilling, completion and reservoir performance as we've successfully done in the Eagleford and Marcellus shales.

"Outside the Wattenberg field, we're also exploring additional liquids-rich horizontal opportunities where we hold another 550,000 net acres in the greater DJ Basin and 360,000 net acres in the Powder River Basin. Each area is prospective for the Horizontal Niobrara, as well as other horizons that we will evaluate over time."

Abonați-vă la:

Postări (Atom)