joi, 22 decembrie 2011

Reliance Industries' KG-D6 gas output falls to new low

Gas production decreased to 39.80 million metric standard cubic meters a day, the news agency said, citing a status report filed by the company with India's oil ministry.

The report said that the output is lower than the 70.39 MMSCMD level envisaged by now as per the field development plan approved in 2006. Reliance started production from the offshore block in April 2009, with output of about 40 MMSCMD, it said.

Reliance holds a 60% interest in KG-D6, while BP PLC has 30% and Niko Resources Ltd. of Canada holds the remainder.

miercuri, 21 decembrie 2011

Raft, lifeboat found at site of Russian rig disaster

The search operation involves three ships, three helicopters and a plane.

The Kolskaya drilling rig capsized in a severe storm off Sakhalin Island’s coast on December 18th. Just 14 of the 67 people on board have been rescued.

The search teams have found 16 bodies of those who died, while the lot of 37 others remains unknown. Investigators are following up on three different leads: towing violations, the oil rig’s technical condition and bad weather conditions.

joi, 15 decembrie 2011

Ultra-deep-water drillship arrives in Gulf of Mexico

The Bully rigs also feature a compact box-type drilling tower, known as a Multi-purpose Tower, instead of a conventional derrick. As the name indicates, a Multi-purpose Tower is designed to maximize productivity and safety, yet it allows for a significantly smaller vessel when compared to other deep water drill ships of similar capacity.

The ships also feature an attention to energy efficiency, use less fuel and are shorter and lighter than comparable drill ships. The Noble Bully I and Noble Bully II, are dynamically positioned drill ships and can, therefore, be positioned at a favorable angle toward wind, waves, and currents, and feature ice-class hulls. Shell and Noble have increased the automated technology on the Bully rigs, increasing personnel safety on board.

The Noble Bully I has now arrived in the Gulf of Mexico from Singapore and will complete commissioning and acceptance testing this month before beginning operations. The Noble Bully I will first drill in Shell's Mars B, "Olympus," development while the

Noble Bully II drill ship is expected to begin operations early next year in Brazil.

miercuri, 14 decembrie 2011

First post-Macondo GOM lease sale sees 28% increase in bids

On December 14, Department of the Interior Secretary Ken Salazar will open Western Gulf of Mexico Lease Sale 218 in New Orleans. The sale, held by the Bureau of Ocean Energy Management (BOEM), has attracted 241 bids submitted by 20 companies on 191 tracts offshore Texas, compared to 189 bids submitted by 27 companies on 162 tracts during the previous Western Gulf Lease sale in August 2009.

Blocks are located in federal waters from nine to more than 250 miles offshore, in water depths of about 16 feet to more than 10,975 feet. BOEM estimates that this sale could result in production of approximately 222 to 423 million barrels of oil and 1.49 to 2.65 Tcf of natural gas.

Sale 218 incorporates a number of lease terms to ensure fair return, provide incentives for diligent development, and help reduce the amount of leased acreage that is warehoused and left unexplored.

marți, 6 decembrie 2011

Gazprom Neft starts drilling in Iraqi Badra deposit

Drilling is expected to be completed in April 2012.

Based on the results, a plan for the most efficient way for development of the deposit will be drawn up, the company said.

"The results of the initial appraisal wells will allow us to better understand the geology of the location, produce a definitive operating plan and move to commercial production of at least 15,000 barrels of oil a day in August 2013," Vadim Yakovlev, first deputy chief executive, said in a statement. Drilling is expected to be completed in April 2012.

Based on the results, a plan for the most efficient way for development of the deposit will be drawn up, the company said.

"The results of the initial appraisal wells will allow us to better understand the geology of the location, produce a definitive operating plan and move to commercial production of at least 15,000 barrels of oil a day in August 2013," Vadim Yakovlev, first deputy chief executive, said in a statement.

luni, 5 decembrie 2011

Rockhopper spuds well at Beverley prospect

The Well is situated on License PL004b in which Rockhopper will earn a 60% interest by drilling 14/15-4. The Well is designed to investigate reservoir presence and hydrocarbon charge towards the southernmost mapped limit of the Sea Lion field and is located approximately 12.1 km to the south west of the 14/10-2 discovery well and 6.3 km to the south of well 14/10-9.

The well is also an exploration well on the Beverley prospect.

The company intends to drill to target depth ("TD") then subsequently sidetrack to core should significant hydrocarbon charged reservoir be encountered in either the Sea Lion Main Complex or Beverley. Initial drilling and logging operations are expected to take approximately 20 days and a further RNS will be issued prior to commencing any sidetrack.

The company intends that 14/15-4 will be the final well it operates during the current drilling campaign.

vineri, 2 decembrie 2011

EnQuest discovers oil at Crathes well

The recent corporate acquisition of Challenger Minerals (North Sea) Limited by Ithaca included a dual target exploration opportunity in Block 21/13a alongside the Scolty and Torphins undeveloped discoveries. The primary exploration target is the Crathes prospect which lies within the Palaeocene section. The secondary target is the Moon prospect within the deeper Upper Jurassic section.

The operator, EnQuest, will evaluate the potential commerciality of the joint development of Scolty, Torphins and Crathes/Moon.

The Joint Venture Partners are: Enquest, operator (40%), Wintershall (E&P) (50%), Ithaca (10%).

joi, 1 decembrie 2011

Breitling Oil and Gas announces completion underway in Garvin County, OK

The Breitling-Butterwash #2 was the second well in Breitling's Butterwash Paul's Valley Uplift prospect. The well was located on the Richardson anticline in south-central Oklahoma. The Breitling-Butterwash #2 targeted the Simpson Sands including the Basal Oil Sandstone.

Breitling Oil and Gas CEO Chris Faulkner stated, "We are excited about the potential in the Breitling-Butterwash #2 within the Richardson anticline."

miercuri, 23 noiembrie 2011

Shell sets world record for deepest subsea oil and gas well

The well, at 9,627 feet below the water’s surface, is located in the Tobago Field 200 miles southwest of Houston in the ultra-deep water of the Gulf of Mexico. Tobago is jointly owned by Shell (32.5%, as operator), Chevron (57.5%), and Nexen (10.0%) and is one of three fields producing through the Perdido drilling and production platform.

Tobago breaks the world water depth record for subsea production, previously held by another field in the Perdido Development, the Silvertip field at 9,356 feet of water.

“Energy is fundamental to global economic growth. Providing this energy must be met practically, safely and in an environmentally responsible manner,” said Marvin Odum, Upstream Americas Director. “Through our highly skilled workforce and cadre of global geoscientists, Shell has applied its advanced seismic and drilling technologies at Perdido to produce additional sources of oil and gas.”

Moored in about 8,000 feet of water, the Perdido platform is jointly owned by Shell (33.34%), BP (33.33%) and Chevron (33.33%) and is the deepest drilling and production facility in the world with a capacity to handle 100,000 barrels of oil per day and 200 million standard cubic feet of gas per day. From Perdido, Shell accesses the Great White,

Tobago, and Silvertip oil and gas fields through subsea wells directly below the facility and from wells up to seven miles away. At its peak, Perdido can produce enough energy to meet the needs of more than two million US households. Shell operates Perdido and its satellite fields on behalf of partners Chevron, Nexen, and BP.

This world-class project began with the 1996 lease sale when the technology to develop hydrocarbons at Perdido’s water depth did not yet exist. By the time the final investment decision for commercial development was made in October 2006, Shell had pioneered several technological firsts which allowed the company to proceed with ultra deepwater oil and gas production. Development drilling began in July 2007, five years after the discovery of hydrocarbons. Perdido produced its first oil and gas on March 31, 2010.

marți, 22 noiembrie 2011

Cairn India unit makes second gas discovery in Sri Lanka

Cairn Lanka made the discovery at the CLPL-Barracuda-1G/1 well in the SL 2007-01-001 exploration block, and the Sri Lankan government has been informed about the discovery, Cairn India said in a statement.

The discovery is located about 68 kilometers from the Sri Lanka coastline, and Cairn Lanka is the sole operator of the block with 100% working interest.

"The reservoirs are predominantly gas bearing with some additional liquid hydrocarbon potential," Cairn said, adding that it will "evaluate the well results and work with appropriate authorities to determine the commercial potential of this discovery."

The company said that the exploration program includes three wells and that it expects to complete the program by early next year, after which it will provide an update on the drilling results.

In October, Cairn Lanka said it made its first gas discovery in Sri Lanka in the Mannar Basin. It was the first hydrocarbon discovery in Sri Lanka and the first well to be drilled there in 30 years.

luni, 21 noiembrie 2011

ExxonMobil to explore for oil in Iraqi Kurdistan

He declined to give further details.

ExxonMobil is the first of the major international oil companies to reach such an agreement with the KRG, which has long been in dispute with Iraq's central government over its right to issue oil exploration licenses.

ExxonMobil declined to comment on the agreement.

ExxonMobil is already operating in Iraq, producing around 370,000 barrels a day of oil from the West Qurna field, under a service contract with the Baghdad government. The Baghdad government has previously excluded companies operating in the Kurdish region from oil contracts in the rest of the country.

vineri, 18 noiembrie 2011

Uganda: Oil exploration investment hits $1.5 billion

In a report, the ministry said the investments have led to the drilling of at least 55 oil wells with 51 of these yielding oil discoveries in three oil blocks on the Ugandan side of the Lake Albertine rift basin.

"This (exploration) represents a success rate of over 92%," the ministry said." Government will continue to pursue investment promotion in the sector with the aim of undertaking further exploration in order to increase the amount of exploitable oil and gas."

The country is expected to call for bids for at least five unlicensed oil blocks early next year, as well as at least 10,000 square kilometers of acreage, relinquished by the current players when the necessary oil legislation have been formulated, the ministry said.

U.K.-based Tullow Oil PLC, which operates the three blocks, is currently in advanced stages of selling two thirds of its stakes in the blocks for $2.9 billion to France's Total SA and China's CNOOC Ltd.\).

joi, 17 noiembrie 2011

Eni's giant Libyan oil field Elephant restarts production

In an interview, Mohamed Jamaleddin, a member of the management committee of Mellitah Oil and Gas BV, said "we started the [first] well gradually" at the Elephant field in the Southern desert.

Reports had previously suggested it could take many months to restart the facility after it was damaged and shutdown during the civil war.

Eni couldn't immediately comment Thursday.

The resumption of Eni's largest Libyan field comes after the recent restart of Repsol YPF SA's giant Sharara field.

Libya now expects production to reach up to 800,000 barrels a day by year end--about half of its pre-war production--, Nuri Berruien, chairman of Libya's National Oil Co., said earlier Thursday.

Mellitah's Jamaleddin also said the "pipeline operation already started" from Elephant at a flow of 40,000 barrels a day, though it is currently transporting oil stored at the field.

Elephant's output normally accounts for about 25% of Eni's Libyan production and, according to Jamaleddin, averaged 130,000 barrels a day before the war.

"Return to full production will take a bit more time," he said. It is currently restricted by limited availability at the local export terminal and will depend on the condition of the wells that are still closed, the official said.

But another Libyan oil official said it could take as little as a week to return to normal.

In another piece of positive news for Eni's Libyan operations, NOC's Berruien said production at the 40,000 barrels-a-day offshore Bouri field could restart "anytime, very soon" but within a week.

miercuri, 16 noiembrie 2011

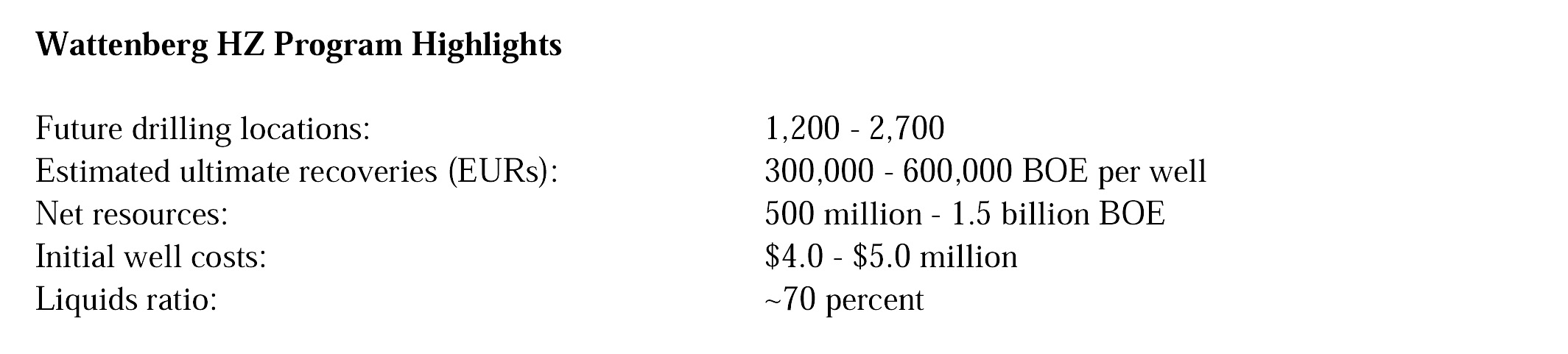

Anadarko reports 1.5 billion bbl find at Niobrara prospect

"Based upon the early results of Anadarko's program in the Wattenberg field, we are confident the liquids-rich Horizontal Niobrara and Codell opportunity provides a net resource potential of 500 million to 1.5 billion BOE (barrels of oil equivalent); and it's located right in the heart of one of our existing core areas," said Anadarko Sr. Vice President, Worldwide Operations, Chuck Meloy. "Our activity, which has primarily targeted the Niobrara formation within the Wattenberg field boundaries, has achieved high liquids yields and excellent well performance with average initial production rates of about 800 BOE per day. The value of this resource is further enhanced by our extensive mineral ownership throughout the Land Grant that provides royalty revenue on both operated and non-operated activity. Our strategic acquisitions of and access to midstream assets in the region that include operated infrastructure, takeaway capacity, NGL (natural gas liquids) processing, and the White Cliffs Oil Pipeline provide us with an additional economic advantage. We expect the alignment of our assets, coupled with future investments in expansion opportunities, will continue to enhance field recoveries, access to premium markets and robust margins."

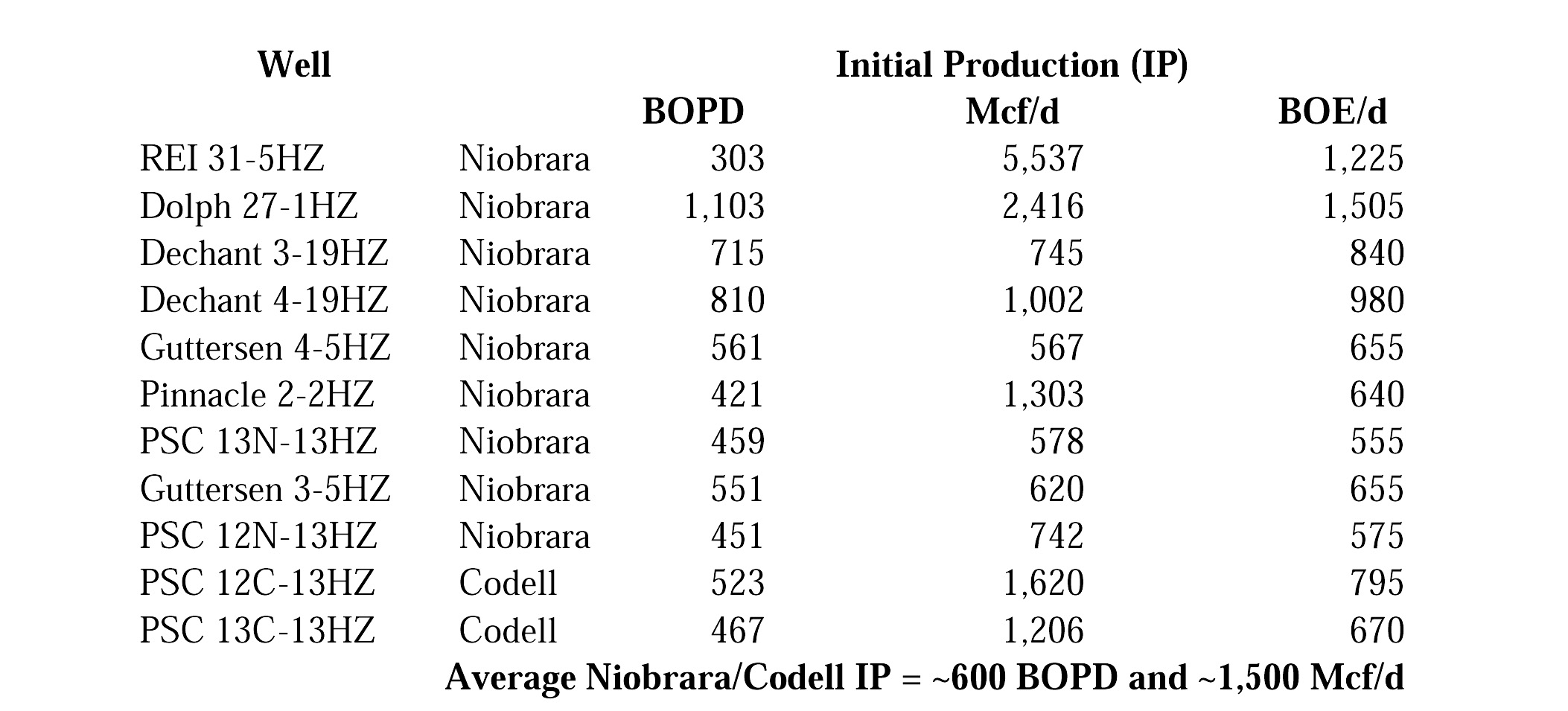

Anadarko's best horizontal well to date, the Dolph 27-1HZ, demonstrated an initial production (IP) rate of more than 1,100 barrels of oil per day (BOPD) with more than 2.4 million cubic feet of natural gas per day (MMcf/d), resulting in an estimated EUR of better than 600,000 BOE. The Dolph well also paid out in less than four months. Results of the company's first 11 operated Horizontal Niobrara and Codell wells are as follows:

Anadarko is the largest net producer in the liquids-rich Denver-Julesburg (DJ) Basin at greater than 70,000 BOE per day. The company holds interests in more than 350,000 net acres in the Wattenberg field, and operates more than 5,200 existing wells with an average working interest of approximately 96 percent, and an average net revenue interest of approximately 88 percent.

As part of its ongoing program, Anadarko will be conducting extensive tests to define the optimum spacing and lateral lengths for the Niobrara and Codell formations. The company also plans to increase the Wattenberg HZ drilling program to seven rigs by the end of 2012, while increasing the number of horizontal wells drilled during the year to approximately 160 from about 40 in 2011.

"The results to date demonstrate the Wattenberg HZ program is among the most cost-efficient development projects in our U.S. onshore portfolio, and with initial wells averaging payouts of 10 months, we expect it to quickly become a self-funding, significant cash-flow generator," said Meloy. "With our extensive land position and the drilling results to date, we envision drilling another 1,200 to 2,700 horizontal wells in the core Wattenberg field acreage. Another value addition for our shareholders is our team's demonstrated ability to apply lessons learned in our other resource plays to optimize the learning curve, and we expect to achieve improvements in drilling, completion and reservoir performance as we've successfully done in the Eagleford and Marcellus shales.

"Outside the Wattenberg field, we're also exploring additional liquids-rich horizontal opportunities where we hold another 550,000 net acres in the greater DJ Basin and 360,000 net acres in the Powder River Basin. Each area is prospective for the Horizontal Niobrara, as well as other horizons that we will evaluate over time."

miercuri, 26 octombrie 2011

China-made drilling rig to be in Cuba by end of 2011

Spokesman Kristian Rix would neither confirm nor deny recent reports of delays as the Scarabeo-9 rig travels to the Caribbean island, but he said the project has always been based on a window of time and things are still on schedule.

Repsol holds the rights to an exploration block off Cuba covering more than 1,700 square miles (nearly 4,500 square kilometers), according to its 2010 annual report. Earlier this year it signed a contract with Italy's Saipem SpA to lease the Scarabeo-9 rig for drilling operations in Cuba.

"Where we're at at the moment is we're expecting the rig to arrive in Cuba just before the end of the year, and the plan as it stands is to begin drilling before the end of the year," Rix said.

According to geologic studies conducted by several institutions, some of them U.S.-based, Cuba's reserves in the Gulf of Mexico could be 5 billion to 9 billion barrels of crude.

The Cuban government has designated dozens of blocks in Gulf waters encompassing 43,200 square miles (112,000 square kilometers) where private energy companies plan to drill deep-water test wells.

None of the companies are American, due to Washington's decades-old embargo banning most U.S. business dealings with the communist-governed island, although some U.S. firms have expressed interest in the past.

Some environmental groups, U.S. politicians and academics have expressed concerns about drilling off Cuba after last year's Deepwater Horizon disaster that killed 11 workers and spilled more than 200 million gallons of oil into the Gulf of Mexico.

Repsol's 2010 annual report says the Sacarabeo-9 complies with U.S. specifications and technical requirements. Cuban officials have also said that the safest, most modern technology will be used.

Earlier this year, Cuba reported its 2010 production totaled 4 million tons of petroleum equivalent, which is oil plus natural gas. That is about 46 percent of its domestic consumption. The rest it obtains from Venezuela on preferential terms.

sâmbătă, 3 septembrie 2011

FX Energy begins drilling Kutno-2 well in Poland

"FX Energy is pleased to be joined in this project by PGNiG, the most experienced explorer in Poland," said David Pierce, the Company's CEO. "Given that Poland currently imports approximately one-third of a Tcf of gas annually, and the Kutno prospect could have an EUR of up to 9.5 Tcf, both companies recognize that this project has the potential to change the energy balance in the entire region."

The current rig will be used to drill the first sections of the well prior to moving Nafta Pila's larger IDM 2000 rig with 500 ton load capacity onto location for the bottom sections of the well. Drilling is expected to take approximately eight to nine months. FX Energy is the operator and will be 50% owner of the Kutno concession; PGNiG will earn 50%.

Plawce-2

The Plawce-2 tight gas well reached total depth of 4,200 meters. Gas shows were encountered as expected throughout the Rotliegend sandstone reservoir. Cores and logs are currently being analyzed. Based upon the results of this analysis, the well is expected to be perforated at the deepest part of the well to determine whether the entire Rotliegend reservoir is water-free. Thereafter, current plans call for perforating and fraccing approximately 50 meters of Rotliegend in the upper portion of the well where porosity is approximately 9-10%. After testing, the well is expected to be completed as a vertical producer.

The Plawce-2 well is located on an uplifted tight Rotliegend block that could contain as much as 500 Bcf of gas in place within the Fences concession. The Company holds a non-operating 49% interest in the Fences concession and the Plawce-2 well; PGNiG operates and holds 51% interest.

U.S. Alberta Bakken

In Montana, FX Energy is in the early stages of appraising the Alberta Bakken oil potential in approximately 75,000 net acres. The Company has drilled and fracced a vertical well in its Cutbank acreage and is currently monitoring the flow back. The Company has drilled a second vertical well in another of its acreage blocks and plans to frac the vertical section. In three to four weeks the Company plans to drill a lateral section of approximately 4,000 feet at this location. Two further wells are planned in the fourth quarter, one vertical and one with a lateral section, assuming results of the Company's first two wells meet technical expectations. FX Energy is operator and holds a one-third working interest in approximately 75,000 net acres; American Eagle Energy, Inc., and Big Sky Operating, LLC, each own a one-third working interest.

vineri, 2 septembrie 2011

Gulfsands makes oil discovery in Syria

BLOCK 26 DRILLING OPERATIONS

YOUSEFIEH EAST EXPLORATION WELL (YOUS-6)

The Yousefieh East exploration well ("Yous-6") has been drilled using the Crosco-E401 rig to test an undrilled structural high in Cretaceous age carbonates located approximately 3 kilometers to the east of the Yousefieh field discovery well (note, this well was erroneously referred to as Yousefieh-8 in a Gulfsands Petroleum plc News Release dated July 11th 2011). The Yous-6 well was deviated at an angle of up to 36 degrees to the vertical in order to avoid obstructions to drilling operations on the surface directly above the target location.

The Yous-6 well encountered oil bearing Cretaceous Massive Formation reservoir at a depth of 2045 meters Measured Depth Below Rotary Table ("m MDBRT") or 1560 meters True Vertical Depth Sub-Sea u("m TVDSS"), 28 meters deep to prognosis. The well penetrated the hydrocarbon bearing Massive reservoir section at an angle of approximately 29 degrees to the vertical. Two twelve meter core sections, parts of which were oil stained, were recovered from the wellbore over the interval 2055-2079m MDBRT (1569-1590m TVDSS). Interpretation of wireline logs indicates a gross porous reservoir interval of 18.1 meters was encountered overlying a non-porous interval, and having a net oil column of 12.8 meters, average porosity of 18% and average oil saturation of 69%.

Pressure data obtained via wireline logs indicates that the oil bearing reservoir is slightly depleted versus initial reservoir conditions, indicating that the Yousefieh East structure is likely to represent an eastern flank extension of the Yousefieh field which is currently on production at approximately 2,600 barrels of oil per day ("bopd"). Reservoir permeability in the Yous-6 net reservoir section is interpreted to be of similar quality to that encountered in the main producing areas of the Yousefieh field.

The Yous-6 well was production tested and produced at an average oil flow rate of approximately 250 bopd of 20 degree API oil for 4 hours on 2 inch choke under nitrogen assisted lift conditions with no water production. The well will be tested further following acidization of the reservoir in a rig-less operation.

Due to a thinner oil column encountered in this well versus other Yousefieh wells, the Yous-6 well will require the installation of permanent artificial lift facilities in order to flow continuously. The Yous-6 well is located within the Yousefieh field Development License Area and can be quickly tied back and produced into the existing Yousefieh field production facilities once artificial lift facilities are secured. Procurement of the relevant equipment is in progress.

The impact of Yous-6 on Yousefieh reserves will be evaluated as part of the year-end reserves review.

SAFA-1 EXPLORATION WELL

Operations have been completed on the Safa-1 exploration well which was drilled using the Crosco M-501 rig. This well targeted a fault-bound dip closed structure of Cretaceous aged reservoir on trend and approximately 7 kilometers north of the Khurbet East Field.

The Safa-1 well is interpreted to have encountered the Cretaceous Shiranish Formation at 1937m MDBRT (1448m TVDSS) and the Cretaceous Massive Formation at 1953m MDBRT (1464m TVDSS). Three consecutive core sections were cut between 1942m and 1975m MDBRT (1453m and 1486m TVDSS), with a total recovery of 31.4 meters of core, sections of which were stained with viscous oil. Evaluation of wireline logs indicates a net reservoir interval of 9.9 meters with an average porosity of 13% and an average oil saturation of 74%.

Well testing operations were conducted in open hole over sections of the gross reservoir column in three stages, however only formation water of low salinity plus traces of viscous oil were recovered to surface, even after an acidification of the net reservoir interval was performed.

The Safa-1 exploration well therefore has been plugged and abandoned as a non-commercial heavy oil discovery.

FORWARD DRILLING PROGRAM

Gulfsands drilling operations in Syria Block 26, using the Crosco E-401 and M-501 drilling rigs, will continue as planned with the drilling of one development and one exploration well.

The Khurbet East-20 well is planned as a delineation well to further evaluate the northern flank of the Khurbet East field. The Wardieh-1 exploration well will target a new exploration play, a combined structural/ stratigraphic trap located on the southern flank of the Souedieh Field at the Cretaceous "Massive" level.

BLOCK 26 OIL PRODUCTION

Production operations on Block 26 continue without interruption. Combined gross oil production from the Khurbet East and Yousefieh fields has averaged in excess of 24,000 bopd to date during the month of August following commissioning of an additional Khurbet East sub-station facility on August 6, 2011.

joi, 1 septembrie 2011

Roc Oil Announces appraisal drilling success

The appraisal well (ZD CP2N-H-1) commenced drilling from the Zhao Dong C4 platform on 15 July and intersected 310 m of horizontal reservoir section. The well was completed, and production through existing C4 facilities has commenced at an initial rate of 3,546 bopd. PetroChina exercised its rights under the PSC to participate with a 51% interest in the new Zhao Dong blocks on the commencement of completion activities and commercial development of the well, effective Aug. 12. The interests in the two new additional blocks are now PetroChina 51%, ROC 39.2% and Sinochem 9.8%.

The company is planning to drill a second appraisal well during 2012.

Commenting on the success of the well, ROC’s CEO, Alan Linn, stated:

"One element of ROC’s strategy is to generate future growth by commercializing near field opportunities through existing infrastructure. Extension of the Zhao Dong block provides an opportunity to incrementally develop a number of existing discoveries through existing Zhao Dong facilities in parallel with ongoing development drilling activities. Exploration opportunities within this acreage could also impact the future profitability and recovery life of the existing assets.

Production from the first appraisal well in the additional Zhao Dong blocks is a positive outcome for all joint venture partners and represents the achievement of another of ROC’s key strategic objectives for 2011: to deliver a new production or pre-development opportunity in China."

miercuri, 31 august 2011

Rosneft, ExxonMobil partner to develop Black Sea resources

“Today's agreement with Rosneft builds on our 15-year successful relationship in the Sakhalin-1 project. Our technology, innovation and project execution capabilities will complement Rosneft’s strengths and experience, especially in the area of understanding the future of Russian shelf development.”

The agreement, signed by Rosneft President Eduard Khudainatov and ExxonMobil Development Company President Neil Duffin in the presence of Russian Prime Minister Vladimir Putin, includes approximately US $3.2 billion to be spent funding exploration of East Prinovozemelskiy Blocks 1, 2 and 3 in the Kara Sea and the Tuapse License Block in the Black Sea, which are among the most promising and least explored offshore areas globally, with high potential for liquids and gas.

In the course of these projects, the companies will use global best practices to develop state-of-the-art safety and environmental protection systems.

The agreement also provides Rosneft with an opportunity to gain equity interest in a number of ExxonMobil’s exploration opportunities in North America, including deep-water Gulf of Mexico and tight oil fields in Texas (USA), as well as additional opportunities in other countries. The companies have also agreed to conduct a joint study of developing tight oil resources in Western Siberia.

The companies will create an Arctic Research and Design Center for Offshore Developments in St. Petersburg, which will be staffed by Rosneft and ExxonMobil employees. The center will use proprietary ExxonMobil and Rosneft technology and will develop new technology to support the joint Arctic projects, including drilling, production and ice-class drilling platforms, as well as other Rosneft projects.

“We have a clear vision for Rosneft’s strategic direction – building world-class expertise in offshore business and enhancing oil recovery,” said Rosneft president Eduard Khudainatov, following the signing ceremony. “The partnership between Rosneft with its unique resource base, and the largest and one of the most highly capitalized companies in the world reflects our commitment to increasing capitalization of our business through application of best-in-class technology, innovative approach to business management, and enhancement of our staff potential. This venture comes as a result of many years of cooperation with ExxonMobil and brings Rosneft into large scale world-class projects, turning the company into a global energy leader."

ExxonMobil Development Company President Neil Duffin said: "Today's agreement with Rosneft builds on our 15-year successful relationship in the Sakhalin-1 project. Our technology, innovation and project execution capabilities will complement Rosneft’s strengths and experience, especially in the area of understanding the future of Russian shelf development.”

Rex Tillerson, chairman and chief executive officer of Exxon Mobil Corporation (NYSE:XOM), who attended the ceremony, said ExxonMobil will benefit Russian energy development by working closely with Rosneft. “This large-scale partnership represents a significant strategic step by both companies,” said Tillerson. “This agreement takes our relationship to a new level and will create substantial value for both companies.”

The agreement provides for constructive dialogue with the Russian Federation government concerning creation of a fiscal regime based on global best practices.

Additionally Rosneft and ExxonMobil will implement a program of staff exchanges of technical and management employees which will help strengthen the relationships between the companies and provide valuable career development opportunities for personnel of both companies.

marți, 30 august 2011

Gulf Keystone announces Shaikan-2 Triassic discovery

Gulf Keystone has completed drilling of the Shaikan-2 Appraisal Well to a TD (total depth) of 3,300 meters in the middle Triassic, following which a flow test has been performed in the newly discovered Kurre Chine C zone over a 80 meter interval (3,195m to 3,275m). This new zone is highly pressured and correlates with the high pressure zone penetrated at the bottom of Shaikan-1.

The Kurre Chine C flow test in Shaikan-2 has achieved variable flow rates up to a maximum recorded rate of 4,450 barrels of 36 degree API oil per day with associated gas of 813,000 scf per day through a 36/64" choke.

After success with this first test, the company plans to continue with its programme of Shaikan-2 testing in the Triassic and Jurassic.

The company has a 75 percent working interest in the Shaikan block and is partnered with the MOL subsidiary, Kalegran Ltd., and Texas Keystone Inc. which have the remaining 20 and 5 percent working interests respectively.

sâmbătă, 27 august 2011

Pemex confirms new light crude discovery

Mexican state oil company Pemex E&P successfully completed trial production in the exploratory well Kinbe-1 (Ruta del Sol), confirming the existence of a new deposit of light crude(37°API), located 87 km northwest of Ciudad del Carmen, in a water depth of 22 m.

This new discovery increases oil potential of the area, which consists of Tsimin, Xux, May fields as part of the Pemex’s light crude marine project.

The well began drilling in May 2010 and ended on August 9 of this year. Average initial production was 5,600 bpd and 9 MMcfd of gas. The producing interval is in the Kimmeridgian formation of the Upper Jurassic.

joi, 25 august 2011

Halliburton completes first horizontal shale gas well in Argentina for Apache

As global development of unconventional resources materialize, Halliburton is in the process of pre-positioning Unconventional Reservoir Solutions Teams around the world. These teams draw upon the extensive knowledge and experience garnered from Halliburton’s unrivalled position in North America's unconventional reservoir development. Halliburton, chosen by Apache because of its Buenos Aires-based Unconventional Reservoir Solutions Team’s expertise and understanding of the specific complexities of the Los Molles shale formation, placed 10 hydraulic fracture stages in the horizontal section at a depth of over 4,400 meters.

"Halliburton’s ability to apply its expertise globally will assist operators to efficiently develop frontier unconventional reservoirs," said Roberto Munoz, vice president, Latin America Region, Halliburton. "With the third largest estimated unconventional reserves after China and the United States, Argentina’s shale gas potential will benefit greatly from the application of these technologies."

miercuri, 24 august 2011

Brazil to hold off on new leasing round

Brazil is unlikely to hold its 11th oil bidding round until early 2012, Mines and Energy Minister Edison Lobao said, according to news reports.

Brazil had hoped to hold the round later this year but President Dilma Rousseff is still reviewing the exploration and production blocks that are expected to be put up for auction, Reuters reported.

Lobao said that the auction could occur in January or February of next year but that none of the highly sought after concession blocks in the subsalt area off Brazil's southeastern coast will be included in the new auction.

New frontier exploratory blocks, including in the Amazon region, are expected to be auctioned, however, as the government tries to open up new reserves beyond the current focus of exploration and production in the subsalt area.

Brazil suspended the auctions of the most promising deep-water blocks in 2007, shortly after state oil company Petrobras discovered massive deposits of light oil and gas in its Santos and Campos basins.

joi, 11 august 2011

Discoverer India to head to US Gulf

The latest fleet report of Transocean has stated that the company will remain in contract with Reliance through February 2013 before returning of drillship to India in the following month. It is also noted in the report that Reliance can extend its contract in US Gulf for further six months. But it is not clear from Transocean that rig would be given to another operator or not. Guy Cantwell spokesperson of Transocean said that the Discoverer India has the capacity to drill down to a depth of 40,000 feet and it can also operate in the depth of 12,000 feet of water.

marți, 9 august 2011

San Leon’s Liesa completes seismic acquisition in Poland

The survey was designed to image the conventional oil and gas potential of the proven Permian sediments in the Nowa Sol area as well as to look at the deeper potential of the Carboniferous source rocks.

The survey will be processed by two independent processing companies, one in the US and one in Poland. Final processed results are expected in September followed by detailed interpretation by the company, with plans to commence a two to three well drilling campaign by the end of 2011.

Oisin Fanning Chairman of San Leon Energy commented, "The completion of the Nowa Sol 3D is another step forward in our drilling plans for Poland. The lower risk oil potential of the area is an important part of our short term strategy to organically grow San Leon in the short term while we continue to explore for the significant longer term gas resources in our portfolio. The safe and successful completion of the Nowa Sol 3D is further evidence of San Leon's operational capabilities. We believe that the Carboniferous section below the proven Permian sediments, an approximate 880,000-acre license position, also offers the potential to be a large unconventional gas play in Europe and we look forward to drilling this later in the year."

luni, 8 august 2011

TGS begins new multi client 3D survey in Faroe Shetland basin

TGS has commenced a new multi-client 3D survey in the Faroe-Shetland basin. The survey covers 2,500 sq km west of the British Isles over quads 6004, 204 and 205 and is acquired in partnership with PGS.

The new seismic data is being acquired by the PGS Ramform Viking towing 12 X 6,000 m with 75 m separation and utilizes PGS' GeoStreamer Technology. Data acquisition will continue through Q3 2011 and the vessel will return in 2012 to complete the survey. Data processing will be performed by both TGS and PGS. "This is TGS' first investment in a 3D multi-client seismic program west of the British Isles, located in an area with a number of discoveries and further undiscovered hydrocarbon potential," stated Kjell Trommestad, SVP Europe & Russia for TGS.sâmbătă, 6 august 2011

Jubilant begins drilling campaign in India Kharsang field

The well will test the Upper Girujan C-50 and D-00 sand layers that are currently producing across 10 existing wells ranging from 25 to 140 bopd. The consortium expects to encounter around 35 meters of net reservoir sand.

The well is part of the seven well Phase-III drilling campaign in Kharsang which is planned to be completed by February 2012. On completion of this well, the rig will move to the next development well of the Phase-III drilling campaign.

GeoEnpro Petroleum Ltd., a joint venture of Geopetrol and Jubilant Enpro (a member of the wider Jubilant Bhartia Group), is the operator of Kharsang Field. Jubilant holds a 25% interest in the block through its subsidiary, Jubilant Energy (Kharsang) Pvt Ltd. The other members of the consortium are Oil India Ltd and Geopetrol.

joi, 4 august 2011

Eni makes new discovery in Kutei basin, offshore Indonesia

The Jangkrik North East discovery represents a significant success in Eni's exploration efforts in the Kutei Basin and further confirms the high potential of its portfolio in the area. The Jangkrik North East NFW is located approximately 70 km from the coast of Indonesia and has been drilled to 3633 m at a water depth of 460 m.

The well contains more than 60 m of net gas pay in excellent quality reservoir sands of Pliocene and Miocene age.

During the production test, the well produced high quality gas at a tubing constrained rate of 30.6 MMscfd.

Eni, through its Indonesian subsidiary, is the operator of Muara Bakau PSC with a 55% interest. GDF SUEZ holds the remaining 45% interest in the project.

Overall, in Indonesia, Eni holds working interests in thirteen blocks, and operates seven of them. The offshore activities are located in the Tarakan and Kutei Basins, offshore Kalimantan, north of Sumatra West Timor and West Papua. In the

Kutei basin, Eni is also participating in the development of the significant gas reserves located in the Ganal and Rapak blocks.

Other activities are located in the Mahakam River Delta, East Kalimantan, where Eni has an equity production of approximately 20,000 boed and has recently been awarded an interest in Sanga Sanga CBM, a new coal-bed methane production sharing contract through its operated joint venture affiliate VICO CBM Limited (Eni 50%, BP 50%). The Sanga Sanga project would be the first LNG plant in the world to be supplied by CBM.

miercuri, 3 august 2011

Gazprom, Petronas sign agreement for 4 blocks offshore Cuba

Russia’s Gazprom Neft announced it has signed a product-sharing contract with Malaysia’s Petronas and Cuba’s Cubapetroleo for four blocks in the Gulf of Mexico offshore Cuba.

Whereas Petronas previously held a 100% stake in the blocks, following the signing, Petronas will retain 70% while Gazprom Neft will acquire 30%. The original farm-out agreement was signed in October 2010.

"This partnership with Petronas will help Gazprom Neft to enforce its competence in the sphere of deep-water development and expand its expertise in projects outside of Russia," Reuters quoted Alexander Dyukov, chairman of Gazprom Neft management board as saying.

Apart from Cuba, Gazprom Neft participates in international exploration and production projects in Iraq, Equatorial Guinea, Venezuela and-through its Serbian affiliate company-in Angola, Romania and Hungary

luni, 11 iulie 2011

Chevron awards GE Oil & Gas offshore GOM contract

GE Oil & Gas will supply three customized aeroderivative gas turbine-generator modules to provide reliable electric power for a new Chevron floating production unit that will produce oil and gas from the Jack and St. Malo fields in the Gulf of Mexico, approximately 280 miles south of New Orleans and at a water depth of approximately 7,000 feet.

GE will provide three LM2500+G4 gas turbine generator modules, each mounted on a three-point support base plate, designed with marine corrosion-resistant materials to overcome footprint restrictions and withstand pitch, roll and acceleration forces anticipated for a floating production unit operating in deep waters.

Marco Caccavale, North America region leader—turbomachinery, GE Oil & Gas said: “We are delighted to have been selected by Chevron for this important Gulf of Mexico project. To optimize reliable performance and efficiency and mitigate the considerable footprint restrictions offshore, we have design-engineered three unique modular solutions featuring GE aeroderivative gas turbine technology at their core. This topside, offshore project reflects GE’s ability to supply mission-critical equipment across key segments of the oil and gas value chain and builds on our track record of supplying fixed and floating projects worldwide, including for projects offshore Angola, Brazil, China and Norway.”

The LM2500+G4 gas turbines will be manufactured by GE Aero Energy in Evendale, Ohio, while the generator package assembly and testing will take place at GE Oil & Gas’ facilities in Massa, Italy. Shipment of the equipment is scheduled to start in December of 2011, with commercial startup planned by early 2013.

Chevron’s initial development of the Jack and St. Malo fields will be comprised of three subsea centers tied back to a hub production facility with an initial capacity of 170,000 barrels of oil and 42.5 million cubic feet of natural gas per day.joi, 7 iulie 2011

BG Group doubles Santos basin net potential to 8 billion boe

The mean Total Reserves and Resources represents a doubling of BG Group's previous best estimate of 3 billion boe prevailing at the time of the Group's February 2010 Strategy Presentation.

The aggregate range of Total Reserves and Resources net to BG Group is from 4 billion boe (P90) to 8 billion boe (P10).

These new estimates result from BG Group's internal analysis based on probabilistic modelling of its Santos Basin interests. The analysis used a wealth of drilling, appraisal and other data that BG Group has gained or developed in relation to those interests, including:

• a total of 29 wells drilled in our existing discoveries; two wells drilled on Lula since November 2010 proving particularly important in delineating the flanks of the field. Other wells have demonstrated excellent connectivity in the reservoir;

• a total of 19 drill stem tests on current discoveries;

• the shooting and analysis of over 14 400 square kilometres of 3D seismic;

• full analysis of a completed extended well test (EWT) on Lula Sul and early results from the Guará EWT indicating the very large hydrocarbon volumes connected to each of these wells;

• production from the first permanent floating production, storage and offloading vessel on Lula which commenced in October 2010;

• development plans that include enhanced recovery processes to improve ultimate recovery factors for these giant fields; and

• cost optimisation, potential debottlenecking of facilities and greater well productivity enhancing the economic viability of later phases of development.

BG Group Chief Executive Sir Frank Chapman said: "The doubling of our estimated Santos Basin mean reserves and resources is clearly significant and demonstrates the continued rapid evolution of our understanding of these enormous discoveries. Robust economics and solid progress with the fast-track development programme will see gross installed production capacity rising steadily to reach more than 2.3 million boe per day by 2017. I believe this - alongside progress with major ventures in Australia, the US and across our global portfolio - will transform the scope, scale and value of BG Group."

miercuri, 6 iulie 2011

ExxonMobil continues cleanup operations in Montana

ExxonMobil Pipeline Company provided the following update as cleanup operations continued Monday following a release of oil into the Yellowstone River.

More than 280 people are now involved in the response and cleanup effort including ExxonMobil’s North America Regional Response Team, the Clean Harbors and ER oil spill response organizations and additional contractors. More than 150 people cleaned up oil along the river banks today.

A unified command has been established to manage response activities, including recovering oil, monitoring air and water quality, and addressing questions from local residents. ExxonMobil is coordinating the response with the Environmental Protection Agency; the Montana Department of Environmental Quality; U.S. Department of Transportation Pipeline and Hazardous Materials Safety Administration; Montana Fish, Wildlife and Parks; Yellowstone County Disaster and Emergency Services; and Yellowstone County commissioners.

For the purposes of the response, the area downriver of the spill has been organized into four zones. Cleanup activities are focused in the first two zones, Laurel to Duck Creek Bridge, a distance of seven miles from the spill location, and Duck Creek Bridge to Johnson Lane (12 miles). Reconnaissance and evaluation activities are under way in the second two zones, Johnson Lane to Miles City (144 miles) and Miles City to Glendive (78 miles).

Active clean up continues in the first two zones closest to the spill site. More than 48,000 feet of absorbent boom and 2,200 feet of containment boom and 2,300 absorbent pads are on site and being used to clean up oil adjacent to the river. Vacuum trucks and tankers have also been deployed to pick up and dispose of the oil.

As of this evening, we have received 94 calls to the community claims line. Of those, 36 were reports from landowners related to oil on their property. We continue to encourage individuals in the community who might have been impacted by this event to contact the claims hotline number (1-888-382-0043).

We are actively conducting reconnaissance in the second two zones. We are ready to deploy resources as needed to clean up oil that may be identified from the spill in these areas.

Daily aerial flights over the river are being undertaken to identify additional oil locations and monitor and direct cleanup activity. As part of our reconnaissance, we are also walking the parts of the shorelines where it is safe to do so.

Given the current flooding and very swift river currents, we will need to wait until it is safe to get into some areas. When we have determined that conditions are safe, we have eight boats staged at Coulson Park for deployment for reconnaissance and monitoring on the river.

We continue to monitor air quality and all previous reports have confirmed no danger to public health. The EPA has conducted water quality sampling and will publicize those findings when they receive the results. Municipal water systems are being notified to monitor water quality but no reports of impacts have been received to date.

Workers from the International Bird Rescue have arrived in Billings. The Montana Audubon Conservation Education Center and Yellowstone Valley Audubon have offered to provide wildlife recovery services and facilities. We have not received any confirmed reports of impacted wildlife but will continue to monitor the area.

marți, 5 iulie 2011

Samson Oil & Gas to acquire additional Bakken acreage

Samson’s new Roosevelt Project is being acquired in three tranches:

Tranche 1 is a 20,000 acre block to be acquired immediately upon closing that includes a two well drilling obligation. Tranche 2 is an option to acquire an additional 20,000 acres upon the completion of the initial two wells in Tranche 1. The location of Tranches 1 and 2 are shown in yellow marked “FPEC” on the map included with this news release. Tranche 3 is a 50,000 acre area covered by an Area of Mutual Interest where Samson and FPEC have agreed to jointly acquire additional leases.

Samson plans to fund its acquisition costs and the drilling of the initial two appraisal wells from its existing cash resources. While Samson’s ultimate ownership interest in the three Tranches will vary, depending on FPEC’s future decisions whether to back in to an interest in the acquired acreage, Samson will hold at least a 66.66% working interest (53.34% net revenue interest) in all of the acquired acreage.

The Roosevelt Project is located in a technically attractive, but largely undrilled part of the Williston Basin. After exhaustive study, Samson’s technical staff has concluded that the area is part of the Bakken continuous oil accumulation with adequate porosity and oil saturation for commercial production. Samson is not alone in reaching such a conclusion as the acreage block is surrounded by leases held by other well-known energy industry participants.

The initial two well drilling program will be initiated as soon as practicable, with a target spud date of September 1st for the first well. Drilling of the second well would be expected immediately following the completion of the first well. Both wells are planned to be drilled as 4,500 foot laterals in the middle Bakken formation and then fracture stimulated using a multi stage, external casing packer completion technique.

Samson has contracted with Halliburton’s (NYSE: HAL) Consulting and Project Management business line to provide well construction planning, and drilling and completion supervision for the initial two wells. This agreement builds on the existing relationship with Halliburton developed through Samson’s Hawk Springs project and brings the considerable expertise of the largest service provider of fracture stimulation completions to Samson’s new Roosevelt Project.

FPEC is owned by Native American Resource Partners (NARP) and the Assiniboine and Sioux Tribes. NARP, a portfolio company of the private equity fund Quantum Energy Partners, has substantial experience in energy transactions with Indian Nations. While Samson is not part of FPEC or NARP, the importance of having both of these Fort Peck Tribes as equity partners, albeit indirectly, was an important part of Samson’s decision to invest in the Roosevelt Project.

The ownership information in the map was developed from public sources and, while Samson believes it to be substantially accurate, neither Samson nor FPEC can guarantee that it is complete or up to date, as subsequent or unrecorded transactions could result in substantial modifications.

Samson’s Ordinary Shares are traded on the Australian Securities Exchange under the symbol "SSN". Samson's American Depository Shares (ADSs) are traded on the New York Stock Exchange AMEX under the symbol "SSN". Each ADS represents 20 fully paid Ordinary Shares of Samson. Samson has a total of 1,996 million ordinary shares issued and outstanding (including 269 million options exercisable at AUD 1.5 cents), which would be the equivalent of 99.8 million ADSs. Accordingly, based on the NYSE AMEX closing price of US$2.68 per ADS on June 23rd, 2011 the company has a current market capitalization of approximately US$262 million. Correspondingly, based on the ASX closing price of A$0.125 on June 23rd, 2011, the company has a current market capitalization of A$245 million. The options have been valued at their closing price of A$0.11 on June 22nd, 2011 and translated to US$ at the current exchange of 1.05 for the purposes of inclusion in the US$ market capitalization calculation.

luni, 4 iulie 2011

Canacol Energy begins heavy oil exploration drilling program in Colombia

Canacol Energy Ltd. Has announced the start of its heavy oil exploration drilling program on its Tamarin and Cedrela Exploration and Production contracts located in the Caguan - Putumayo Basin in Colombia. The Corporation has 100% working interest and is operator of both contracts, which represent approximately 388,000 net acres. The Corporation plans to drill two stratigraphic wells, one on each of the Tamarin and Cedrela contracts, in a back to back drilling campaign that will commence in mid July 2011. This will be followed by the drilling of five conventional exploration wells, the first to start in late Q3 2011, and the last to end midyear 2012.

Charle Gamba, President and CEO of the Corporation, commented "The stratigraphic wells will target two large structures recently defined by the new 2D seismic acquired on the Tamarin and Cedrela blocks. These wells, which can be drilled relatively inexpensively compared to conventional exploration wells, have the potential to yield useful information concerning the presence and type of oil, as well as basic reservoir thickness and quality information, in advance of the conventional exploration drilling program the Corporation plans to start in late Q3 2011. Since the discovery of the Capella heavy oil field by Canacol and its partner in 2008, the Corporation has been able to leverage its proprietary knowledge of the geology and potential of the area. The Corporation is now positioned to execute a significant heavy oil exploration program in this emerging heavy oil play in Colombia."

Tamarin ESTR-1 Stratigraphic Well

The Tamarin ESTR-1 well is planned to be drilled to a depth of 3,260 feet measured depth ("ft md") and will target potential heavy oil bearing reservoirs in the Mirador sandstones, the main producing sandstones in the Corporation's Capella heavy oil field. The Corporation has a 100% working interest and is operator of the Tamarin contract, which represents 68,000 net acres and is located on trend approximately 25 kilometers to the southwest of the Capella heavy oil field.

The Corporation has executed a contract with LT Geoperaciones y Mineria Ltda., a service company that will provide the drilling rig. The Corporation anticipates that the well will take approximately 8 weeks to drill, core, and log. The information that the Corporation anticipates to collect include cores through the prospective reservoir intervals and a full suite of conventional openhole wireline logs. This data will yield information concerning the thickness, porosity, permeability, and fluid content of any prospective reservoir intervals that may be encountered within the well. Given the small size of the wellbore, the Corporation will be unable to flow test any of the prospective reservoirs.

The Corporation is currently constructing the surface location and anticipates that the Tamarin ESTR-1 will commence drilling in mid July 2011.

Cedrela ESTR-1 Stratigraphic Well

The Cedrela ESTR-1 well is planned to be drilled to a depth of 2,600 feet measured depth ("ft md") and will also target potential heavy oil bearing reservoirs in the Mirador sandstones, the main producing sandstones in the Corporation's Capella heavy oil field. The Corporation has a 100% working interest and is operator of the Cedrela contract, which represents 320,000 net acres and is located on trend approximately 50 kilometers to the southwest of the Capella heavy oil field.

The Corporation anticipates spudding the Cedrela ESTR-1 stratigraphic well after the drilling of the Tamarin ESTR-1 well has been completed. The Corporation anticipates that the Cedrela ESTR-1 well will take approximately 8 weeks to drill, core, and log. The same information that the Corporation plans to collect in the Tamarin ESTR-1 well will also be collected in the Cedrela ESTR-1 well.

vineri, 1 iulie 2011

Solimar has 33 million bbl target in drilling Paloma field appraisal well

Solimar Energy Limited has announced that the Nabors Rig # 710 has been contracted to drill the Paloma Deep - 1 well and is expected onsite in late July. Commencement of drilling is likely in early August.

The Paloma West project is operated by Neon Energy and covers some 1400 acres all within the structural closure of the Paloma oil and gas field which has produced some 61 million barrels of light oil and 432 billion cubic feet of gas (133 MMBOE) since discovery in the 1930’s. The Paloma field is a large anticline structure some 12 miles long by 4 miles wide.

The well location has been chosen using 3D seismic which was acquired after the prior development of the field. The Paloma Deep -1 will be the first appraisal well drilled on the field using 3D to help identify favourable reservoir trends within the field closure.

There are seven (7) individual, stacked reservoir targets in the well commencing at approximately 10,000 feet. The well has a planned total depth of 15,500 feet and will take up to 2 months to drill. All the targeted sandstone and shale reservoirs are part of the Miocene age Monterey Formation, the famous oil source and reservoir formation in the southern San Joaquin Basin. The estimated unrisked in place hydrocarbon volumes are up to 300 million barrels OPI and based on an 11% recovery factor (equivalent to the historic recovery from the main producing reservoir of the Paloma field) the targeted recoverable resource is 33 MMBOE.

The well will drill though a series of shallower Pliocene mostly dry gas reservoirs on the way down that are expected to be depleted by historic production. Some of these sand reservoirs are equivalent to the San Joaquin Formation gas sands that Solimar is attempting to develop at its SELH gas project further to the northwest in the basin. The shallow sands produced 23 Billion cubic feet (Bcf) of gas at Paloma.

The first reservoir to be evaluated will be in the Antelope Shale member of the Monterey which envelopes the main reservoir of the field, the Paloma or Upper Stevens Sandstone. This sand has produced 58 mmbbls and 415 Bcf and is likely to be at least partially depleted at the well location and is therefore considered a secondary target.

All the Monterey Formation sandstone reservoirs including the Paloma Sandstone were originally formed as submarine fans derived from the NE and deposited into the deep water basin prevalent in the San Joaquin Basin during the Miocene. The anticlinal structure which traps the hydrocarbons was formed much later and has a different, NW – SE orientation. So there has been varying sand quality encountered across the field which affected the historic field development, particularly for the Lower Stevens Sandstone reservoirs which were not discovered until 1973.

Only three wells have penetrated to the deeper reservoir levels in the west half of the field area (the most recent being some 26 years ago in 1985) each encountering extensive live oil and gas shows and with two wells flowing oil and gas at low rates.

Solimar believes that the 3D seismic data and modern drilling and completion technologies provide an excellent chance for a successful appraisal of the sandstone reservoirs in the western Paloma oil field.

Unlike most of the original field wells that were drilled using water based muds that can react with clays in the reservoir reducing permeability ( or ability to flow), the Paloma Deep - 1 will be drilled with a synthetic oil based mud to reduce drill time and minimise formation damage.

With the exception of one old vertical well recompleted for production in the Antelope Shale in 1993 the fractured oil shale potential of the acreage remains untapped. In the context of the escalating production and re development of equivalent rocks in other fields in the area, the fractured oil shales present an exciting opportunity for the new joint venture.

Solimar is increasing its interest via farmin with Neon. The increased position will either be a minimum 17.5% with 25% targeted and pending closure of arrangements with a third party. Once the level of increase has been finalised this will be confirmed via a further announcement by the Company.

The increased position in the project will be subject to any consents to assignment of the interests that may be required by the underlying lessors and to completion of Solimar’s previously announced private placement to raise A$7 million. The dry hole cost of the Paloma Deep -1 is estimated at US$4.9 million. Solimar will be funding its share from cash reserves and the proceeds of the placement.miercuri, 29 iunie 2011

Repsol, partners make ‘most significant’ oil discovery yet in Campos basin

The well, located 190 kilometers off the coast of Rio de Janeiro, was drilled with the latest-generation Stena DrillMAX drillship in a water depth of 2,708 meters (8,885 feet), reaching a final depth of 6,851 meters (22,477 feet).

The consortium is currently analyzing the results of the well before continuing with exploration and evaluation work in the area.

Repsol Sinopec, with a 35% stake, is the operator of the exploration consortium, in partnership with Statoil (35%) and Petrobras (30%).

Repsol Sinopec and the consortium informed the Brazilian authorities of the existence of traces of hydrocarbons in the Gávea exploratory well in March 2011 for the first level and April for the second one.

Repsol Sinopec is the largest foreign owner of exploration rights in the Santos, Campos and Espírito Santo basins, participating in 16 blocks of which it operates 6.

joi, 16 iunie 2011

Goodrich Petroleum acquires 74,000 net acres in Tuscaloosa marine shale oil trend

The company anticipates development to commence in the first quarter of 2012.

miercuri, 15 iunie 2011

ExxonMobil unveils recoverable resources of 700 MMboe in deepwater GOM discoveries

“As one of the largest lease holders in the Gulf of Mexico with interests in over 370 leases, we are committed to the continued safe exploration and development of this important national resource”

The KC919-3 wildcat well confirmed the presence of a second oil accumulation in Keathley Canyon block 919. The well encountered more than 475 feet of net oil pay and a minor amount of gas in predominantly Pliocene high-quality sandstone reservoirs. The well, which is continuing to drill deeper, is located 250 miles southwest of New Orleans in approximately 7,000 feet of water.

Drilling in early 2010 encountered oil and natural gas at Hadrian North in KC919 and extending into KC918, with over 550 feet of net oil pay and a minor amount of gas in high-quality Pliocene and Upper Miocene sandstone reservoirs.

ExxonMobil encountered 200 feet of natural gas pay in Pliocene sandstone reservoirs at its Hadrian South prospect in Keathley Canyon block 964 during drilling in 2009.

“We estimate a recoverable resource of more than 700 million barrels of oil equivalent combined in our Keathley Canyon blocks,” said Steve Greenlee, president of ExxonMobil Exploration Company. "This is one of the largest discoveries in the Gulf of Mexico in the last decade. More than 85 percent of the resource is oil with additional upside potential."

“We plan to work with our joint venture partners and other lessees in the area to determine the best way to safely develop these resources as rapidly as possible,” Greenlee said.

ExxonMobil is the operator of KC918, KC919, KC963 and KC964 with 50 percent working interest. Eni Petroleum US LLC and Petrobras America Inc. each hold a 25 percent working interest in KC919, KC963 and KC964. Petrobras America Inc. holds a 50 percent working interest in KC918.

Over the past decade, ExxonMobil has drilled 36 deepwater wells in the Gulf of Mexico in water ranging from 4,000 feet to 8,700 feet.

"As one of the largest lease holders in the Gulf of Mexico with interests in over 370 leases, we are committed to the continued safe exploration and development of this important national resource," Greenlee said.

marți, 10 mai 2011

Sonangol approves Cobalt's offshore Angola plans

Given the proximity of the well locations, Cobalt plans to drill the surface hole of Bicuar-1, move the rig to Cameia-1 to drill and evaluate the prospect, then return to Bicuar-1 to drill the well to total depth. The operator anticipates that exploratory drilling will commence in second quarter 2012. Cameia is located in a water depth of 5,577 feet (1,700 meters) and Bicuar lies in 5,085 feet (1,550 meters).

luni, 9 mai 2011

Treaty Energy selects Belize drilling locations

Andrew V. Reid, Treaty Energy's CEO, indicated, "The first of several items issued today is that Treaty Energy Corporation has engaged a law firm in Belize City, Belize, for the purpose of forming a Belizean corporation to be named Treaty Belize Energy, Ltd. All of our business activities in Belize will be handled through this wholly owned subsidiary. As of May 2nd Treaty was told by our Belizean law firm that all filings were done and we are waiting on the 'Certificate of Incorporation' which we expect from the registry promptly."

Reid also explained that Treaty has selected five 'AREAS' as the first of innumerable well sites and has identified the first eight drilling locations that are to be drilled on the land portion of the Princess/Treaty Concession.

• AREA #1: Elevation – 108'

• AREA #2: This very encouraging location is right off Monkey River Road, and shows promise for many wells. This location was staked with one well location approximately 20' back from the seal on the oil side. Due to lack of time on this formation further study will be done. The one well is expected to be 1200' deep to the top of the formation.The Company has been informed by the geoscience team identifying these drilling locations that we can expect multiple wells on this formation at about 600' intervals.

• AREA # 3: This third formation is located near the end of Monkey River Road. A well location has not been chosen on this location as of yet because it will require clearing certain areas to obtain access to specific drilling locations.j

• AREA # 4: This fourth formation was along Southern Highway toward Punta Gorda.The first well staked is close to Southern Highway inside a guarded area that will be easy to drill. The second well is located about 50' off a good dirt road.

• AREA #5: This fifth location is on Southern Highway in Medina Bank.

In conclusion, CEO Andrew Reid indicated, "We are now in the final process with regard to contracting a drilling company. We are currently evaluating a highly qualified company out of Guatemala City, but other companies are also being considered, some of which are based in the United States. It has been determined that an air drilling approach would be very successful in the areas that we will be exploring. Since air drilling can be faster and would likely create less contamination and/or damage to the oil bearing formations, all factors are being considered prior to issuing the contract for the first well."

Treaty is engaged in the acquisition, development and production of oil and natural gas. Treaty acquires and develops oil and gas leases which have "proven but undeveloped reserves" at the time of acquisition. These properties are not strategic to large exploration-oriented oil and gas companies. This strategy allows Treaty to develop and produce oil and natural gas with tremendously decreased risk, cost and time involved in traditional exploration.

sâmbătă, 7 mai 2011

NPD to conduct seismic acquisition near Jan Mayen

Last fall, the Norwegian government resolved that an impact assessment would be made of the maritime zones off Jan Mayen, with a view to future petroleum activity. The NPD's acquisition of seismic data is part of this impact assessment. Seismic data acquisition around Jan Mayen is also planned for next summer.

The data acquisition will take place using the vessel R.V. Harrier Explorer operated by PGS, and with the aid of PGS' Geostreamer technology. This is a new technology for seismic acquisition, characterized in part by the fact that the streamer, which in this case is eight kilometres long, is towed somewhat deeper in the water than is the case in conventional seismic acquisition. This means that the streamer can withstand higher waves, thus making the acquisition activity less dependent on weather and consequently more efficient.

vineri, 6 mai 2011

Petrobras strikes oil in Campos basin's Albacora field

Preliminary volume estimates indicate an economically recoverable volume potential of nearly 350 million barrels of good quality oil. Drilled in a water depth of 1,247 feet (380 meters) by the Ocean Concord, the well reached a total depth of 15,863 feet (4,835 meters). An oil column of 791 feet (241 meters) was found, of which 341 feet (104 meters) are from the carbonate reservoirs of the Macabu Formation, with a porosity of around 10%.

joi, 5 mai 2011

Eni, Sonatrach partner to develop shale gas in Algeria

Eni and Sonatrach have signed a cooperation agreement for the development of unconventional oil, with particular focus on shale gas reinforcing the close relationship between the two companies.

With extensive experience in exploration and production of unconventional oil, Eni and Sonatrach will jointly implement activities to assess the technical and commercial feasibility of exploration and operational initiatives in shale gas.Based on previous assessments, Eni confirms the significant shale gas reserves in Algeria which Eni and Sonatrach wish to explore and develop. This will enable both companies to make important discoveries which will enhance the gas potential of the country.

Eni has been in Algeria since 1981. Eni's equity production is currently 75,000 barrels per day. In Algeria, Eni holds 24 licenses in production, 8 licenses under development and an ongoing exploration license.

miercuri, 4 mai 2011

Chesapeake halts fracking ops at several PA well sites after blowout

After a blowout at natural gas well in a Bradford County, PA last week, Chesapeake Energy will suspend all hydraulic fracturing (“fracking”) operations at several of the company’s sites in Pennsylvania. The blowout occurred at the Atgas 2H well during a fracking operation, leading to spilling of thousands of gallons of drilling fluid and water.

According to the Associated Press, thousands of gallons of produced water flowed back out of the well, crossing farm fields and entering a stream. Chesapeake stopped the leak by using materials such as ground up tires and plastic at plug the well.

Chesapeake is working to permanently seal the well and investigate the cause of the blowout.

The company stated that it has suspended fracking operations on seven well sites in Pennsylvania.

marți, 3 mai 2011

COSL takes delivery of 12-streamer seismic vessel

COSL 720 is the first large-scale domestic deep-water seismic vessel invested and constructed by COSL. The vessel will be capable of towing 12 streamers each 8000m long to carry out seismic survey operation. The operational indicators have met the international standards with the capability to perform high-density seismic collection for 50-meter-distance streamer. The vessel can withstand the seismic pressure of 3000PSI (regular collection: 2000PSI), with the endurance of 75 days, designed speed of 16 knots and towing speed of 5 knots, which the speed improved by 30% from the Group's existing seismic vessels and will significantly reduce the mobilization and demobilization time and increase operation efficiency.

As the most advanced deep-water seismic survey vessel built in China so far, COSL 720 is designed to be a safe, highly efficient, environmental-friendly and energy-saving vessel with emphasis on its performance, collection capacity, the equipment stability, energy saving and emission reduction. COSL 720 is equipped with a new generation of seismic collection system, integrated navigation system and lateral control system. Meanwhile, the full set of remote operating system will increase operation efficiency and reduce labor intensity. The vessel is equipped with a complete diesel-electric propulsion system which is able to effectively reduce vessel fuel consumption, vibration and noise. The system also contributes to improve the quality of seismic collection and the comfort of working and living environment for the crew.

After delivery, COSL 720 will commence operation in South China Sea upon completing the collection test of geophysical equipment, the working volume of which is expected to reach 100% in 2011.

Mr. Li Yong, CEO and President of COSL, said, "Global crude oil price picked up from the bottom and hit USD100 per barrel. Oil companies are gradually increasing their demand for oil and gas exploration. This offers good opportunity for the recovery and development of oilfield services, particularly geophysical services, while bringing new requirements for high quality geophysical services in terms of performance of equipment, technical level and work efficiency.

Meanwhile, with China's progressive advancement of deep-water exploration, COSL will also further embark on its deep-water oilfield service. The successful delivery of COSL 720 enhances COSL's competitiveness and equipment for geophysical services, and also improves the company's capability of deep-water services. COSL will continually improve the relevant chains for this service, laying solid foundation for China's deep-water operation."

luni, 2 mai 2011

Ecopetrol announces new discovery in Huila

Ecopetrol informs that it has found the presence of hydrocarbons in the Nunda-1 well, located in the municipality of Tello in Huila province.

The well is part of the Cuisinde Exploration and Exploitation Agreement of 2006 between Ecopetrol and the National Hydrocarbons Agency, ANH in which the company holds a 100% stake.

Drilling at the well began on January 27, 2011, reaching a total depth of 7,371 feet three weeks later, the equivalent of 2.25 kilometers from the surface.

Preliminary testing on the Honda formation showed a flow volume of 318 barrels, with a 71% water cut, yielding an average of 92 barrels of oil per day. The quality of the crude is 30 degrees API.

Ecopetrol will begin appraising the find in the weeks ahead, with extensive tests planned in order to determine the production potential of the Honda formation and the volume of recoverable hydrocarbons.

The discovery opens up a new era for Ecopetrol by branching out to new types of exploration activities involving stratigraphic traps (those in which hydrocarbons accumulate due to variations in the deposit environment) in the Valle Superior del Magdalena and helps increase reserve inventories in this area of the country.

sâmbătă, 30 aprilie 2011

BGP Challenger completes seismic survey offshore Oman

The work area is located in Block 52, and close to the water areas of Somalia and Yemen, the piracy-prone areas. To make sure the project to be operated smoothly, BGP made rigorous security measures and emergency plan, and employed several security personnel from IBS, an international security company.

The acquisition program proved to be extremely challenging. The work area is covered by intensive fishing boats and nets, and islands. Even more frustrating for the BGP Challenger, was the unpredictable position and movement of the boats and nets. The experienced international crew on board coped well and has subsequently achieved excellent productivity.

The client is very impressed with both the productivity and the quality of data acquired by BGP. The BGP Challenger has demonstrated BGP's position as a leading geophysical contractor in the oil and gas industry.

vineri, 29 aprilie 2011

Bowleven makes discovery offshore Cameroon

The Sapele sidetrack encountered about 75 feet (23 meters) of net hydrocarbon-bearing pay in the Omicron objectives. The well reached a true vertical depth of 11,923 feet (3,634 meters), 14,708 feet (4,483 meters) measured depth, in a water depth of around 82 feet (25 meters) on the MLHP-5 block in the Etinde permit.

Its main objective was to appraise the Deep Omicron oil discovery encountered in the Sapele-1 exploratory well and to intersect the Upper and Lower Omicron objectives. The well intersected 4.5 feet (1.4 meters) of net pay overlying 79 feet (24 meters) of high quality reservoir which has been confirmed as water-bearing.