"Based upon the early results of Anadarko's program in the Wattenberg field, we are confident the liquids-rich Horizontal Niobrara and Codell opportunity provides a net resource potential of 500 million to 1.5 billion BOE (barrels of oil equivalent); and it's located right in the heart of one of our existing core areas," said Anadarko Sr. Vice President, Worldwide Operations, Chuck Meloy. "Our activity, which has primarily targeted the Niobrara formation within the Wattenberg field boundaries, has achieved high liquids yields and excellent well performance with average initial production rates of about 800 BOE per day. The value of this resource is further enhanced by our extensive mineral ownership throughout the Land Grant that provides royalty revenue on both operated and non-operated activity. Our strategic acquisitions of and access to midstream assets in the region that include operated infrastructure, takeaway capacity, NGL (natural gas liquids) processing, and the White Cliffs Oil Pipeline provide us with an additional economic advantage. We expect the alignment of our assets, coupled with future investments in expansion opportunities, will continue to enhance field recoveries, access to premium markets and robust margins."

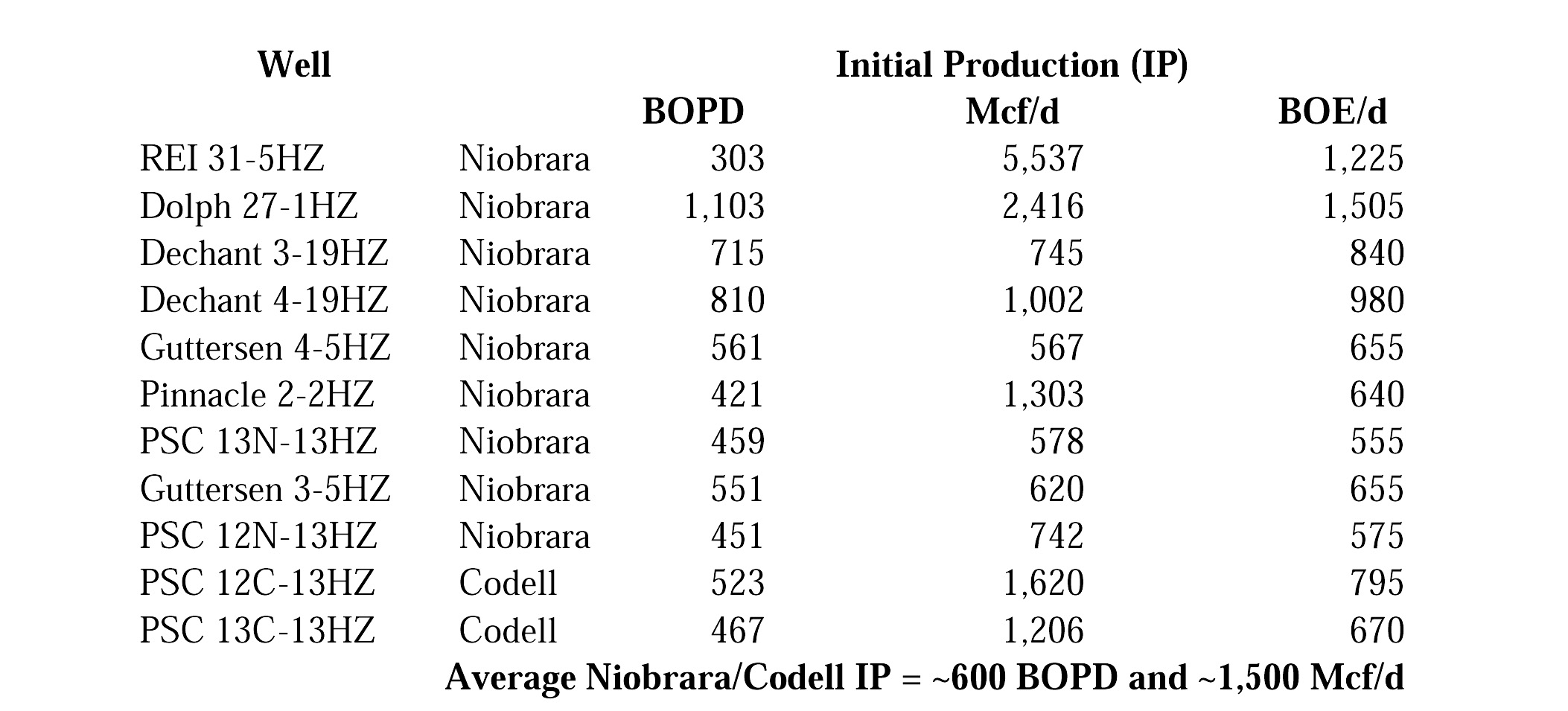

Anadarko's best horizontal well to date, the Dolph 27-1HZ, demonstrated an initial production (IP) rate of more than 1,100 barrels of oil per day (BOPD) with more than 2.4 million cubic feet of natural gas per day (MMcf/d), resulting in an estimated EUR of better than 600,000 BOE. The Dolph well also paid out in less than four months. Results of the company's first 11 operated Horizontal Niobrara and Codell wells are as follows:

Anadarko is the largest net producer in the liquids-rich Denver-Julesburg (DJ) Basin at greater than 70,000 BOE per day. The company holds interests in more than 350,000 net acres in the Wattenberg field, and operates more than 5,200 existing wells with an average working interest of approximately 96 percent, and an average net revenue interest of approximately 88 percent.

As part of its ongoing program, Anadarko will be conducting extensive tests to define the optimum spacing and lateral lengths for the Niobrara and Codell formations. The company also plans to increase the Wattenberg HZ drilling program to seven rigs by the end of 2012, while increasing the number of horizontal wells drilled during the year to approximately 160 from about 40 in 2011.

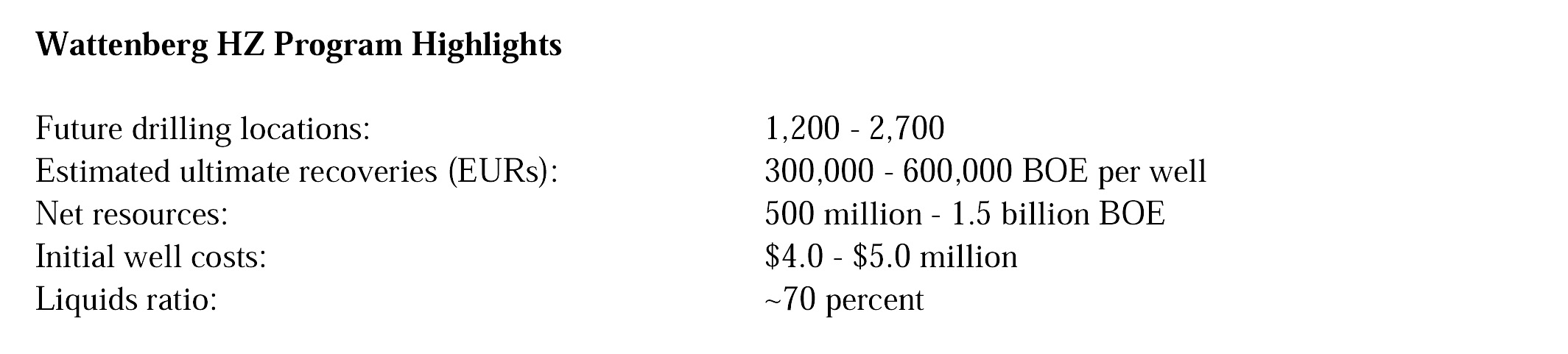

"The results to date demonstrate the Wattenberg HZ program is among the most cost-efficient development projects in our U.S. onshore portfolio, and with initial wells averaging payouts of 10 months, we expect it to quickly become a self-funding, significant cash-flow generator," said Meloy. "With our extensive land position and the drilling results to date, we envision drilling another 1,200 to 2,700 horizontal wells in the core Wattenberg field acreage. Another value addition for our shareholders is our team's demonstrated ability to apply lessons learned in our other resource plays to optimize the learning curve, and we expect to achieve improvements in drilling, completion and reservoir performance as we've successfully done in the Eagleford and Marcellus shales.

"Outside the Wattenberg field, we're also exploring additional liquids-rich horizontal opportunities where we hold another 550,000 net acres in the greater DJ Basin and 360,000 net acres in the Powder River Basin. Each area is prospective for the Horizontal Niobrara, as well as other horizons that we will evaluate over time."

Niciun comentariu:

Trimiteți un comentariu